TikToker Questions If S$3,800 Is Enough To Live Comfortably In Singapore

For many in Singapore, their finances are simply too tight for them to lead a comfortable lifestyle. In some cases, the salaries from our jobs might not be enough to get by either.

This was certainly what a TikToker thought after breaking down a typical graduate’s salary — which he set at S$3,800.

@edrick_lie Day 20/60: Welcoming 9% GST in 2024… #60dayschallenge #elections2023 #singapore #fyp #CapCut

After deducting the typical expenses, the user found that they’d be left with just S$80 of savings.

TikToker asks if average graduate salary of S$3,800 is enough to live comfortably.

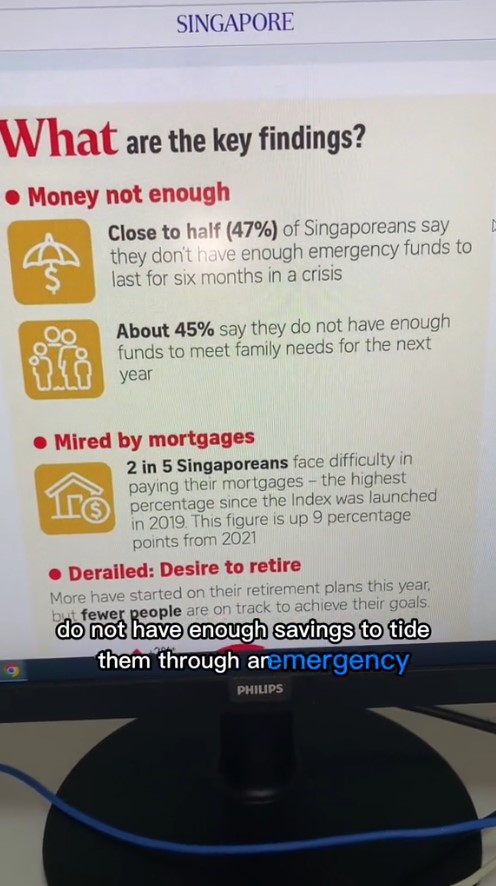

Edrick, the TikTok user in question, started by sharing The Straits Times’ (ST) findings that 47% of Singaporeans do not have enough emergency funds to last them through six months.

Source: TikTok

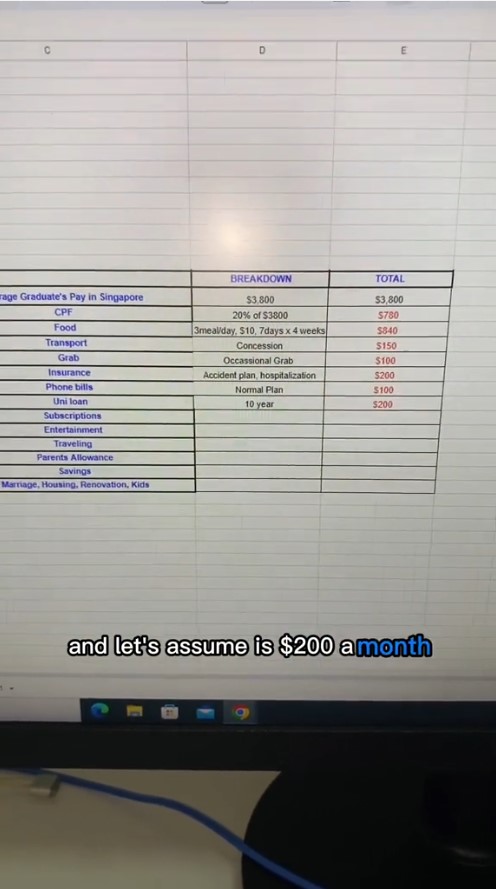

He decided to find out if this was true, basing his calculations on a salary of S$3,800, which he deemed was an average graduate’s pay.

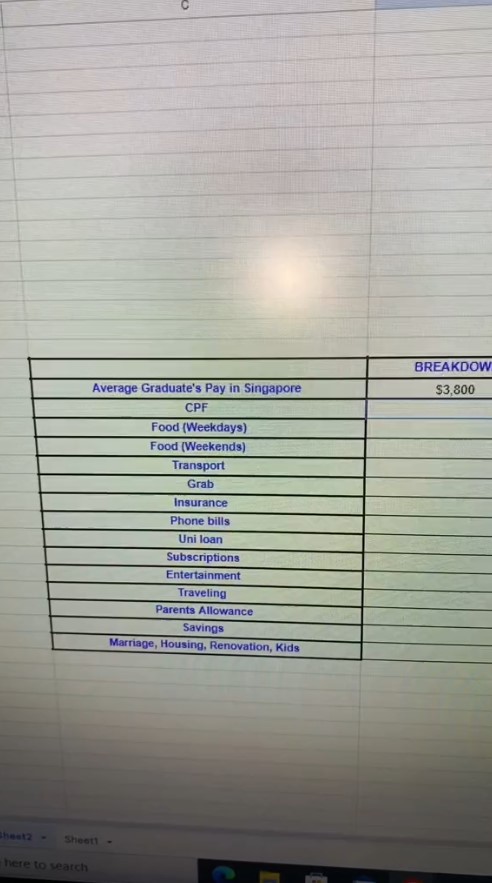

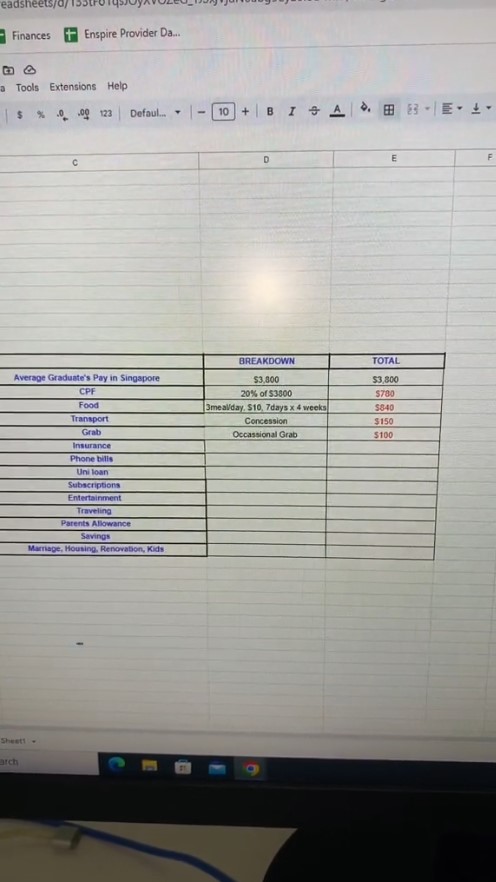

Edrick went on to share a list of expenses Singaporeans would typically have to spend on. This included expenses one would incur for food, transport, insurance, and phone bills.

Source: TikTok

After deducting Central Provident Fund (CPF) contributions, Edrick found that the graduate would be left with about S$3,020.

Assuming the graduate eats three meals daily and spends S$10 for each of them, the food expenses will add up to about S$840.

Edrick then set aside S$250 for travel expenses — about S$150 for an adult monthly concession card and S$100 for the occasional Grab ride.

Source: TikTok

Calculations include expenses such as entertainment

Next on the list are basic insurance fees and phone bills, which Edrick estimates to be S$200 and S$100 monthly.

Source: TikTok

Assuming the graduate had taken up a 10-year loan for their university fees, Edrick estimates that this would come up to about S$200 per month.

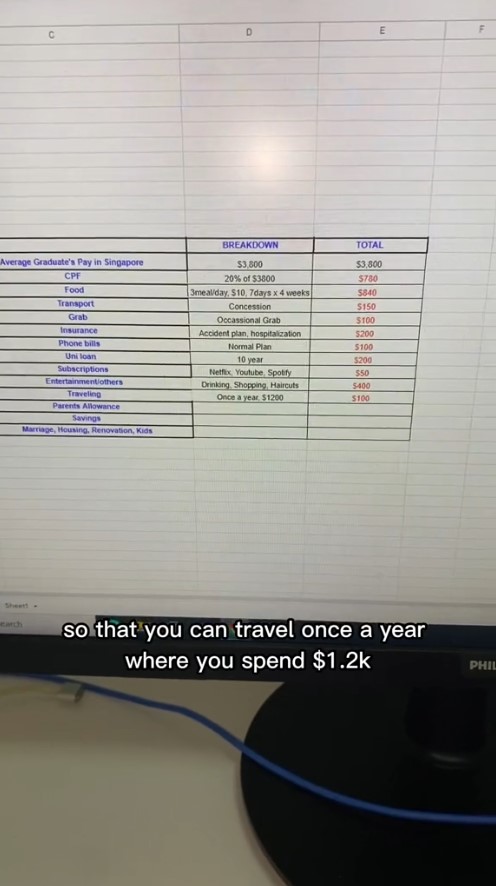

As for entertainment platforms such as Netflix, YouTube, and Spotify, Edrick allocated a generous amount of S$100. However, he acknowledged that sharing such platforms with friends could reduce it to S$50.

Edrick also set aside S$400 for miscellaneous expenses such as drinking and shopping. Saving up for an annual overseas trip would require S$100 to be set aside every month.

Source: TikTok

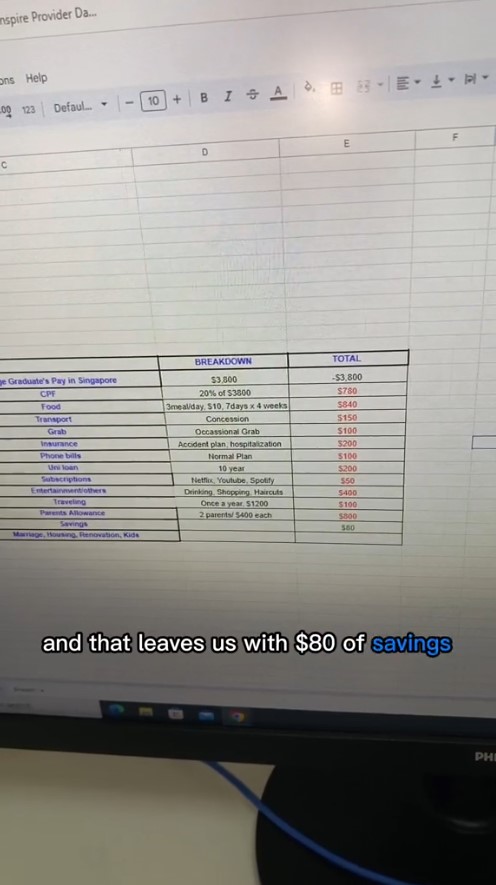

After accounting for parents’ allowance, which Edrick estimates to be S$400 per parent, the graduate would be left with just S$80 for savings.

Source: TikTok

“To lead a comfortable life, we need much more,” he concluded.

But instead of asking graduates to find ways to save more, Edrick advised them to “focus on increasing your [their] value and earning ability”.

TikTok users divided on salary breakdown

The TikTok video has since garnered considerable attention on the social media platform, sparking debate among users.

One user said he was able to save 80% of his monthly salary simply by prioritising their savings.

Source: TikTok

Another argued that they paid S$25 to S$30 for their phone bills, much lower than Edrick’s projected amount.

Source: TikTok

There were others, however, who supported Edrick’s calculations, with one pointing out that the numbers included trade-offs.

Source: TikTok

Regardless of whether we agree with Edrick’s breakdown, his advice on upskilling is one we should all aspire towards.

Do you agree with Edrick’s calculations and which aspects do you think we can save on? Share your thoughts in the comments below.

Also read: NUS Student Intern At Accounting Firm Reveals Her Daily Expenses, Spent S$385 In A Week

NUS Student Intern At Accounting Firm Reveals Her Daily Expenses, Spent S$385 In A Week

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from TikTok.