Revolut — A Free Multi-Currency Wallet With No Ridiculous Transaction or Exchange Fees

Running out of cash in a foreign country can be quite a nightmare. This is where multi-currency accounts like Revolut’s app come in useful — not only to save you from such situations, but also help you prepare for a trip.

Multi-currency wallets work like this. You transfer money into a ‘digital bank’, you get to seamlessly convert the money to any other supported currency, and you get to spend it locally or overseas via a debit card issued by the wallet.

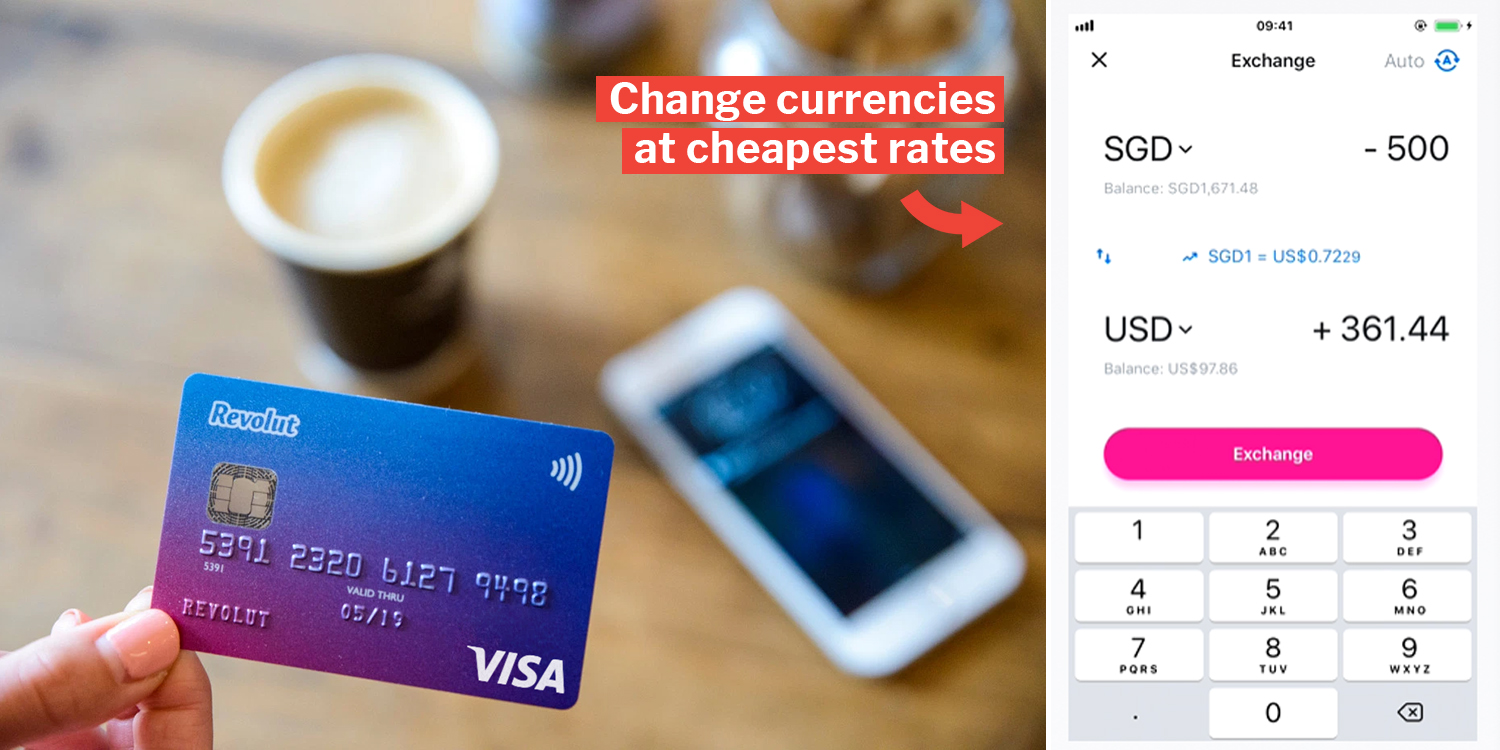

A Revolut debit card

A Revolut debit card

Image from Revolut

At a glance, Revolut has:

- Zero transaction fees when using the card overseas in over 150 countries

- Real-time exchange rates with no markups and commission fees

- Zero overseas ATM withdrawal fees for a fixed amount (up to $1,050/month)

Using regular credit cards overseas usually incurs transaction fees, administrative fees, FX fees, etc. Revolut does away with this and makes it fair and transparent – letting you live a global lifestyle.

Changing currencies is similar. Revolut uses the real-time interbank exchange rate i.e. the rates you see on Google, which is very likely better than any you’ll find in Raffles Place or Mustafa. And you get to do it all on your phone.

Finally, withdrawing cash from an overseas ATM comes without additional charges too — especially useful for places where most vendors accept only cash.

Physical and virtual cards

There are 3 kinds of cards you can apply for with the Revolut app:

- Physical

- Virtual

- Disposable virtual

Physical cards are like your ordinary debit cards — usable at both online and offline stores. The difference is that Revolut cards won’t charge you transaction fees when you use them overseas. It even comes with anti-fraud features like location-based security.

A virtual card works like a debit card too, except it’s virtual i.e. on your phone only. This means you can use different virtual cards to manage different expenditures like your subscription services like Spotify, Netflix, etc.

The last one, a disposable virtual card, is for those who wish to be extra cautious when making purchases online. It’s a card that is usable only once – it ‘self-destructs’ upon payment and regenerates after. This way, if an online store is hacked and the hackers obtain your card information, the numbers are practically useless.

A virtual card changes numbers after every purchase

3 tiers of free & paid membership

Revolut offers 3 membership tiers:

- Standard (Free)

- Premium (S$9.99/month)

- Metal (S$19.99/month)

The differences lie in the volume of foreign exchange transactions, the amount of fee-free ATM withdrawals you can make overseas and other perks like unlimited disposable virtual cards, global medical insurance, a dedicated concierge from within the app, and even cashback for your spendings abroad. For the full list of extra benefits, you can look here.

The Revolut Metal Card fashioned out of steel

The Revolut Metal Card fashioned out of steel

Image adapted from Finder

Standard is a really good deal by itself, considering the convenience it brings to your travel planning and the real-time interbank exchange rates with zero transaction fees.

But if you’re a frequent traveller, a premium or metal membership may save you a whole lot more time, trouble and worry (think about access to more than 1000 airport lounges and free global medical insurance*).

*For more information, visit here.

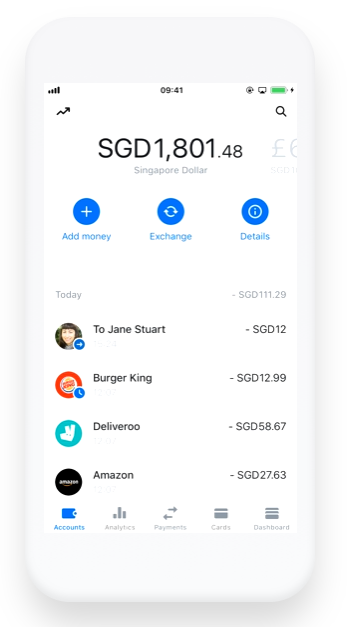

App tracks expenses & makes transfers easier

Much like our local fund transfer wallets, the Revolut app similarly lets you make transfers (think a global PayNow) and keep track of your expenses.

To further plan your expenses, the app lets you create multiple vaults. For instance, you can have a Bangkok holiday vault and home loan repayment vault where you can set aside money for.

Finally, as an interesting addition, Revolut has an optional round-up feature. It works by rounding up your transaction to the nearest whole number (and even multiply it) and storing the difference in your vault. Suppose I spend $1.70 on a drink. Rounded up, it’s $2. Revolut automatically moves $0.30 into the vault you’re putting money away for any purpose.

There are probably a few other smaller features I missed out, but the big ones should all be up there. Nevertheless, a good way to know if the app suits you is to test it out yourself. Even better if you’re going on a holiday soon and can’t find the time to visit a money changer (the queues are usually quite long during this time).

For more information on Revolut or to register, visit here.

This post is brought to you in collaboration with Revolut.

Featured image by MS News.

Drop us your email so you won't miss the latest news.