Higher GST Voucher Cash Payouts To Cushion Rising Costs Caused By Inflation And GST Hike

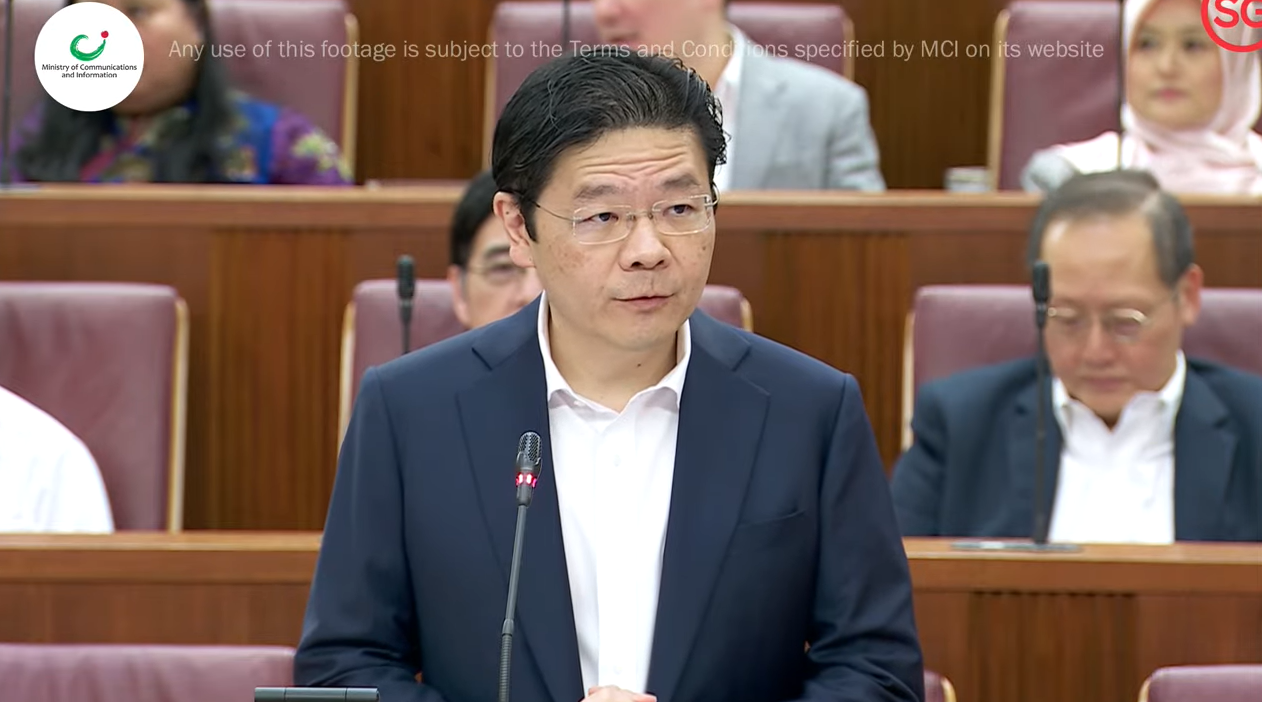

During the Budget 2023 speech on Tuesday (14 Feb), Finance Minister Lawrence Wong announced enhancements to the GST Voucher (GSTV) scheme.

For 2023, eligible Singaporeans will receive S$700 in GST Vouchers, up from S$500. This will be further increased from S$850 from 2024 onwards.

Source: MCI Singapore on YouTube

The cash payouts received are dependent on the recipients’ property value.

Enhanced GST Voucher scheme will cushion impact of GST hike

On Tuesday (14 Feb), Minister Wong announced that the permanent GSTV scheme will be further enhanced, providing support to Singaporeans amidst the inflation surge and GST increase.

This will help residents tide through the current period of higher inflation as well as cushion the impact of higher GST rates, he said.

The GST rate rose to 8% in January this year and will increase further to 9% in January 2024.

The permanent GSTV scheme provides Singaporeans with an annual accessible income of up to S$34,000 with a cash quantum. This, in turn, will help defray GST expenses.

Mr Wong announced that the cash payout this year will increase from S$500 to S$700 for eligible Singaporeans living in homes with an annual value of S$13,000 or below.

From 2024, the payout will be increased to S$850.

This is applicable to all HDB homes as well as some lower-end private properties, reported Channel NewsAsia (CNA).

For those living in a property with an annual value above S$13,000 and up to S$21,000, they will receive a cash payout of S$350.

In 2024, this quantum will increase to S$450.

Will benefit retirees and low-income households

The enhanced permanent GSTV cash payouts will reportedly benefit about 1.5 million adult Singaporeans every year.

In Parliament, Mr Wong said this ensures that most retirees and low-income households will not be affected by the GST hike.

Under the GST system – which includes the GST and GSTV – more well-off consumers, foreigners, and tourists will be subject to higher effective GST rates than lower-income Singaporeans.

“This ensures that those with greater means contribute their fair share of taxes,” he said.

It will also effectively lower the burden of taxes on lower and middle-income Singaporeans.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image by MS News.

Drop us your email so you won't miss the latest news.