Singapore Government calls off Income Insurance-Allianz deal

The Singapore Government has blocked the proposed deal between NTUC Income and German insurance giant Allianz, citing public interest concerns.

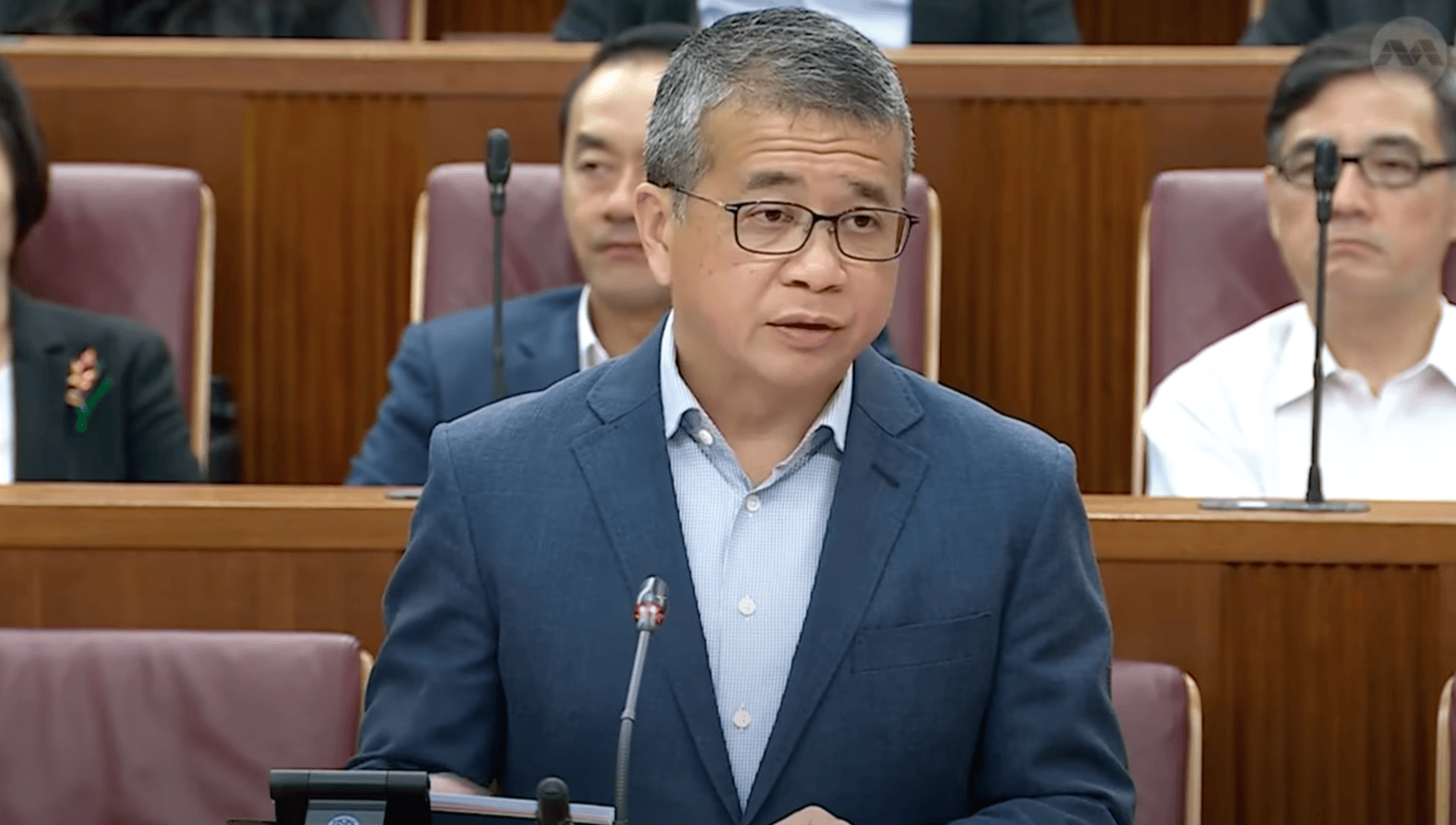

This decision was announced by Minister for Culture, Community, and Youth (MCCY) Edwin Tong during a parliamentary session on Monday (14 Oct).

The deal, announced on 17 July, would have seen Allianz acquiring a 51 percent majority stake in Income, a move MCCY says may undermine Income’s ability to fulfil its social mission.

Deal may negatively impact Income’s social mission

“The Government has assessed the proposed transaction and has decided that it would not be in the public interest for the transaction, in its current form, to proceed,” Mr Tong said.

He highlighted concerns about how the transaction could weaken Income’s ability to support the broader cooperative movement in Singapore.

Source: Reuters

Income, which transitioned from a cooperative to a private company in 2022, retained about S$2 billion in surplus funds under a unique exemption.

Ordinarily, such funds would be allocated to bolster Singapore’s cooperative movement. MCCY, however, has pointed out that there is no clear plan for how these funds will contribute to Income’s social objectives under the current terms of the deal.

The MCCY expressed concerns that the proposed capital reduction contradicts the purpose of the exemption and could weaken Income’s social mission and that of other cooperatives.

Additionally, the ministry is uncertain whether Income can continue to fulfil its social mission under the proposed terms.

“There are no clear binding provisions or structural protections in the deal to ensure that Income’s social mission will be discharged,” said Mr Tong.

The proposed deal would also make NTUC Enterprise a minority shareholder, limiting its board representation and preventing it from appointing a chairman.

Source: Channel NewsAsia on YouTube

These factors, taken together with the proposed capital reduction and the absence of structural safeguards in the deal to ensure continuation of Income’s social mission, pose a risk “that MCCY judges not to be acceptable”, he said.

Government open to new arrangements for Income

Mr Tong clarified that while Allianz’s suitability as an investor is not in question, the Government finds the terms of the current deal problematic.

The Government’s concerns are focused solely on the “terms and structure” of the proposed transaction.

He stressed that the MCCY is open to exploring new proposals from Income with Allianz or other partners, provided these risks are addressed.

Prime Minister Lawrence Wong echoed this in a Facebook post, saying:

In the course of reviewing NTUC Enterprise’s proposed sale of Income shares to Allianz, we came across additional information that gave us cause for concern. The Government has therefore decided not to approve the transaction.

He added that the Government supports finding a strong partner for Income “to strengthen its capital base and market position”.

However, the Government’s concerns stem from assurances given by Income when it was corporatised in 2022, he said.

Mr Tong also said in Parliament that the Government intends to amend the Insurance Act to provide “clear statutory basis” for MCCY’s views to be considered in applications related to insurers that are either a co-op or linked to a co-op.

PM Wong added that the amendment will “allow MAS (the Monetary Authority of Singapore) to withhold approval of the sale on the grounds of public interest when it involves a current or former cooperative insurer”.

Public & prominent figures against the deal

The proposal faced public scrutiny and opposition from notable figures shortly after its announcement in July, with many publicly speaking out against the deal.

Diplomat Tommy Koh stressed that NTUC was founded to provide affordable insurance and that Income Insurance and FairPrice should never be sold.

NTUC Income became a public non-listed company in 2022, enabling it to receive investments from firms like Allianz, which wasn’t possible as a cooperative.

Former NTUC Income Co-operative CEO Tan Suee Chieh also opposed the deal, stating that the cooperative aimed “not to maximise profits, but to maximise social impact”.

He also expressed hope that leaders would make decisions that would “benefit Singaporeans long-term”.

Also read: Commentary: Income affair shows a S’pore that is out of touch

Commentary: Income affair shows a S’pore that is out of touch

Have news you must share? Get in touch with us via email at news@mustsharenews.com.