Singaporean Man Fined For Undeclared Luxury Bags Purchased Overseas With Girlfriend

When travelling, many look forward to splurging, especially on luxury items priced cheaper than in Singapore.

However, as tempting as it may be, it isn’t a good idea to try evading taxes on these items, as authorities are stepping up their efforts at ensuring compliance with the laws.

Recently, 115 travellers were found to have failed to declare and pay duties and Goods and Services Tax (GST) on their items at Changi Airport.

Among them was a man who had to pay S$1,106 in GST and a fine for five undeclared luxury bags worth S$13,825. He had bought these items overseas with his girlfriend.

Authorities fine man caught with undeclared luxury bags worth S$13K

In a media release today (29 May), the Immigration and Checkpoints Authority (ICA) and the Singapore Customs shared that they found 115 travellers who failed to declare and pay duties and GST through a joint-enforcement operation.

During the operation, authorities did enhanced checks on inbound travellers at the Arrival Halls of all Changi Airport terminals.

Source: @cherrystyled on Flickr

Their luggage was also inspected for undeclared dutiable and taxable goods, as well as any prohibited or controlled goods.

Items that require declaration include:

- Cigarettes and tobacco products

- Liquors in excess of their duty-free allowance

- Taxable goods exceeding their GST import relief allowance

ICA and Customs recovered a total of S$18,491 in duty and GST through their operation. Close to S$28,000 in penalty was additionally collected.

In their media release, ICA underlined four cases where they handed out fines on top of GST.

Most notable was a Singaporean man caught with five luxury bags he and his girlfriend purchased overseas. They did not declare their purchases upon arrival.

Source: Singapore Customs

They had to pay S$1,106 in GST for the bags, valued at S$13,825.

3 more travellers also fined for undeclared goods

The three other cases involved included a Singaporean woman with an undeclared luxury watch and bag valued at S$5,637. She had to pay S$450.96 in GST.

Source: Singapore Customs

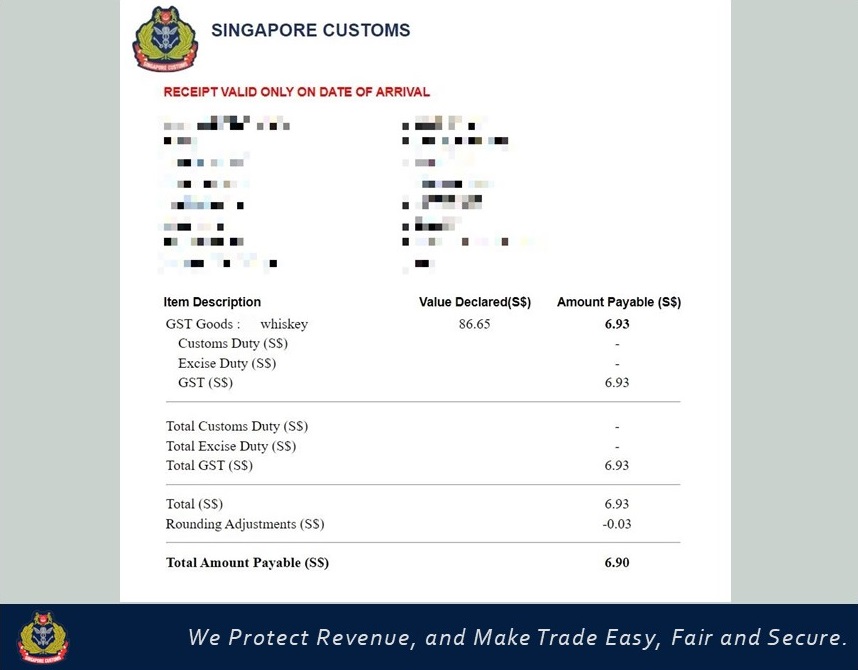

The authorities also identified a male Employment Pass Holder who falsely declared a bottle of whisky as GST Goods using the Customs@SG application. He supposedly did so to avoid paying S$15.14 in excise duty.

Source: Singapore Customs

The last case involved a male foreigner with six packets of cigarettes wrapped in a ‘Happy Birthday’ foil wrapper.

Authorities urge travellers to declare items truthfully

In their media release, ICA and Singapore Customs shared that they will continue to conduct joint-enforcement operations regularly to ensure compliance with laws.

Under the Customs Act, those involved in the fraudulent evasion of any customs duty or excise duty may be liable to a fine of up to 20 times the amount of duty and GST they evaded. They may also face up to two years of imprisonment.

Ms Sung Pik Wan, Senior Assistant Director-General (Checkpoints), Singapore Customs, said, “It is the responsibility of all arriving travellers to make an accurate and complete declaration of all dutiable and taxable items in their possession upon arrival.”

She added, “We urge everyone to declare and pay for their purchases truthfully”.

When in doubt, travellers can refer to the Customs website for more information or consult Singapore Customs officers at the Customs Tax Payment Office.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Singapore Customs.