Reduce Your Utility Bills By Shaking These 8 Habits

Moving into a spanking new Build-To-Order (BTO) flat with your partner is an exciting milestone, but it does come with its fair share of challenges.

One of the biggest woes young couples face is being saddled with loans to pay off, especially in the first few years after getting a place to call their own.

Now that there are monthly loans to repay, you’d want to keep an eye out for ways to keep your bills down to a minimum.

Here are some of the most common household habits you can change to reduce your monthly utility bills.

1. Overcharging mobile phones

Though our phones often have our undivided attention, watching it top all the way till 100% may take up precious time for more important matters. Thus, leaving it to charge overnight is naturally the easy way out for many of us.

Doing this, however, will harm your phone’s battery, as well as your wallet, at least when you receive your next utility bill.

As long as your phones are plugged in, they will continue to draw a small amount of electricity from the outlet.

It might take a little more effort to remember charging your phones a few hours before bed, but you’ll be doing yourself a favour by saving energy – and your wallet – both at once.

2. Leaving plugs in sockets

For many of us, switching off the TV simply means pushing the power button after a good binge-watch session.

But as long as appliances like televisions, microwaves, and printers are left plugged in, they’ll secretly consume electricity even when they’re not in use.

Even with the switch turned off, energy is still constantly being drawn so devices can power up quickly.

So, just take a few extra seconds to unplug your devices. This nifty little trick can save you up to $25 a year.

And when monthly loans are waiting to be paid off, we can all agree that every cent counts.

3. Not replacing older appliances

Old appliances that mum and dad gifted you with before leaving your family home and moving in with bae may be dear to your heart. But they can be secretly racking up your utility bills.

Older appliances like fridges, washing machines, and dryers consume much more energy than newer energy-saving models.

So while large purchases seem like something to scrimp and save on when you’re moving into a new home, you might want to invest in new appliances somewhere down the road.

Replacing just 1 or 2 devices can save you up to hundreds of dollars on your electricity bill.

4. Reboiling hot water

There’s nothing quite like sipping on a cup of piping hot coffee or tea to start your day. When you have boiled water ready on hand, it saves you time in the morning — and some electricity.

In fact, using a thermos flask to store hot water instead of re-boiling each time could save you a whopping $300 a year.

Plus, you’ll be able to make your coffee with the push of a button on your thermos flask.

So invest in a thermos flask and don’t let your electricity bills boil over.

5. Overloading the washing machine

Owning a home comes with taking on more responsibilities, even in the little things like doing your own chores.

At such times, it might be tempting to reduce your workload by leaving large loads of laundry to do all at once.

We know underloading a machine would waste energy but overloading a washing machine is also a common mistake.

Waiting till the laundry piles up and stuffing your workout clothes, PJs, and bae’s work clothes into the washing machine at one go may seem wise. But this puts stress on the appliance, making it less efficient.

It might even damage the machine’s drum, and your clothes might not even be adequately cleaned.

So even if you’re short on time or desperately need that top for tomorrow, be careful not to overload your machine. It might just be causing that spike in your utility bills.

6. Using hot water to wash clothes

There’s more to saving energy when doing laundry than just putting in the optimal load. Washing at the right temperature can also help you save on bills.

Using hot water to wash clothes will get those pesky stains from your messy lunch off your clothes faster, but there’s a cost to it.

90% of the energy used by a washing machine goes to heating the water.

By using cold water, you’ll preserve your clothes’ colouring better, and you’ll also be glad you did when the utility bill comes at the end of the month.

7. Not servicing air conditioners

Singapore’s eternally hot weather may have you switching on your air conditioner regularly, and the more you use it, the more often you should maintain it.

Neglecting maintenance can result in clogged filters that cause energy usage to increase.

If you realise your air conditioner isn’t as cooling as before, this could be why.

Perhaps now would be an excellent time to schedule your next servicing appointment before you see its effects on your bills.

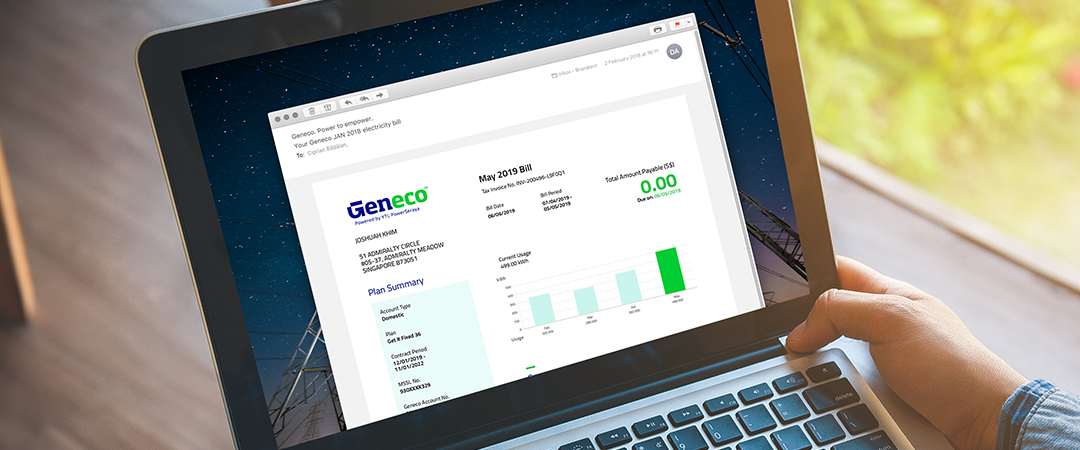

8. Not switching to Geneco’s Get It Fixed 24 plan

There are many decisions to make when moving into a new home, including choosing an energy provider.

And while you’re making such significant changes in your life, you might want to nail down the things you can control.

In that case, switching to Geneco’s Get It Fixed 24 plan will help ease the headaches of your utility bills by keeping them constant.

The Get It Fixed 24 plan offers a fixed rate of 19.58¢/kWh for 2 years compared to regulated tariff of 24.13¢/kWh (as of 29 Apr 2021).

If you spend about $100 on your utility bills each month, this would mean saving up to $452.22 in 2 years at the current price.

Eliminating worries about fluctuating prices will also let you plan your finances as a couple better to prepare for future expenses.

Get up to $165 off bills with a Geneco plan

If you like the idea of a fixed electricity plan at home, Geneco, one of Singapore’s leading electricity suppliers, lets consumers have massive, or rather May-ssive, savings this month.

Hopping over to the Get It Fixed 24 plan will give you the chance to enjoy the highest bill rebate offered — $165.

You can start by keying in this promo code for an $80 rebate: GENECO80

Geneco believes in the power of word-of-mouth, so they’re also rewarding you when you jio your friends and family on board. Each successful referral will earn you a $50 rebate, currently the highest referral rebate in town.

You can stack these rebates with credit card offers to get up to $35 additional bill rebates. All you’ll need to do is charge recurring bill payments to your credit cards from Citibank, HSBC, POSB or UOB.

With the $80 plan rebate, $50 referral rebate, and the $35 credit card rebate, you’ll essentially have $165 rebate in total after signing up.

If what you’re reading now lights up your life, check out Geneco’s website for more information before this limited-time offer ends.

Kick old habits & get the right plan to start anew

Stepping into the world of adulting by getting a place of your own can be daunting when you think about the enormous costs involved.

These tips and tricks will certainly show you that getting rid of old habits and having the right plan can significantly reduce your utility bills.

Hopefully, after making some simple changes to your lifestyle habits, you can then enjoy the comforts of your new home a little better.

This post was brought to you in collaboration with Geneco.

Featured image adapted from Flickr.