Netflix GST To Be Paid By Users In 2020 Under New Online Services Tax

This year may be your last chance to enjoy GST-free prices for Netflix, Spotify & Amazon Prime.

More than 100 overseas vendors of online services will be charging GST to consumers starting 1 Jan 2020 — including the music & movie-streaming giants, reports The Straits Times.

We help you navigate the latest GST changes for online services in the new year — expected to generate S$90 million/year in tax revenue for Singapore.

Netflix GST in effect from 1 Jan 2020

Come 1 Jan 2020, Netflix will be subject to a goods and services tax (GST), after an online services tax was announced in 2018’s Budget.

Netflix joins about 100 other registered digital service vendors who’ll be able to charge GST to their customers next year.

Taxable digital services are defined as such:

A service supplied over the internet or an electronic network that requires minimal or no human intervention.

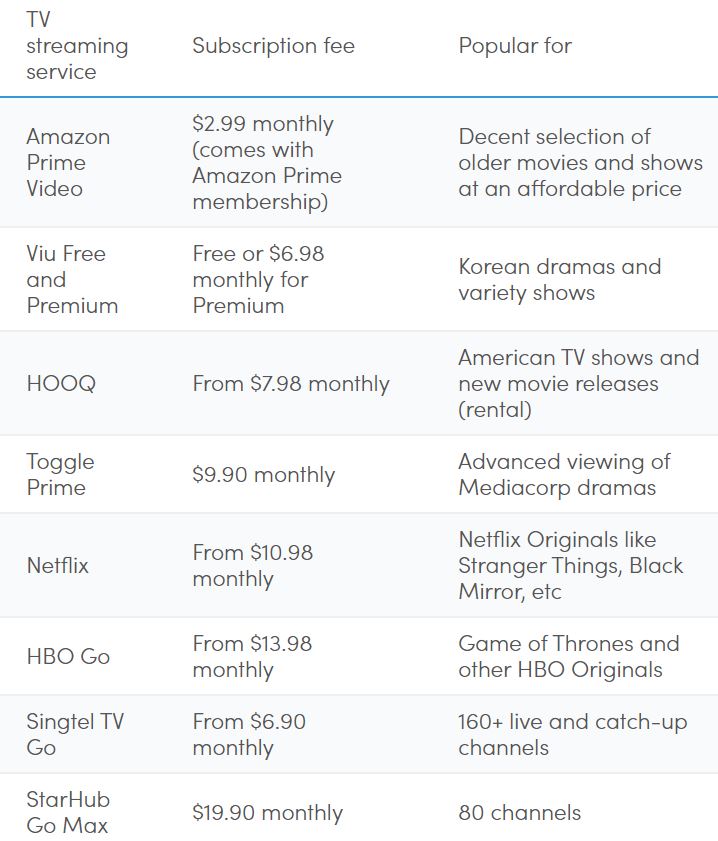

Here’s a handy list of Netflix alternatives by CBInsights — like Viu, Viki, Catchplay, HBO Go, IFLIX, HOOQ and Amazon Prime Video.

What other services are affected?

You may be wondering if Spotify falls under the same umbrella?

Well, if the digital service provider you’re engaging has a yearly global turnover of more than S$1 million, and sells more than S$100,000 of digital services to locals in a year, they’ll be required to charge GST.

From our quick search on IRAS’ MyTax portal, major services who will probably charge GST in 2020 are as follows:

- Netflix

- Spotify

- Amazon

- Apple Music / Apple TV

- Rakuten (Viki)

MoneySmart has also compiled a useful streaming subscription fee list as pictured above for your reference.

Under S$400 Taobao shopping sprees are exempt for now

Online shopping sprees aren’t subject to GST yet — you won’t have to pay GST for importing anything under $400 via air or post.

This means your Taobao shopping hauls are safe — for now.

Exceed this threshold, however, and GST is already required for imports.

How can I check if an online service is allowed to charge GST?

IRAS encourages consumers to report fradulent GST charges for online services immediately.

Especially if they aren’t registered to charge you, but you see an additional tax on your bill.

Check if your service is registered to charge for GST here.

S$90 million in tax revenue collected per year

Deputy Prime Minister Heng Swee Keat confirmed in 2018, that the online GST for imported services is expected to bring in $90 million/year in tax revenue.

The new measure is to “defend our revenue base” as purchases move online, he claimed. Based on 2016 figures, Singapore imported close to S$225 billion in services.

Are you ready for 7% GST on Netflix?

Singapore will be following in the footsteps of countries like Japan, New Zealand & Australia by introducing an online service tax.

Do make sure that the account you’re charging your online subscriptions to, has sufficient funds to account for the extra 7% GST, once the new year rolls around.

Do you have any thoughts about the new online GST policy? We’d love to hear your feedback on the new measure below.

Featured image adapted from Netflix & Twitter.