Filing Your Personal Income Tax 101

So you’ve just received a letter from the Inland Revenue Authority of Singapore (IRAS) reminding you to file your income tax.

You head over to IRAS website, ready to make that first important step as an adult. But there’s information everywhere and you don’t know where to start.

Here’s a short guide.

Who needs to file?

Received a letter telling you to file? You have to file. Even if you didn’t make money last year, you have to file. Maybe IRAS just wants to know what you’re up to.

Filing is different from paying. Filing means telling IRAS how much you earned last year and what tax reliefs you’re eligible for. You only pay when the tax bill arrives, which is usually some time between May to Sept.

On the other hand, if you received a letter telling you that you’re under the “No-Filing Service“, you don’t have to file anything — IRAS already knows how much you earn and you’ll only need to check that your details are correct.

But as a rule, if you earned more than $22,000 (before CPF deductions) last year, you will probably have to file.

Steps to filing your income tax

There are 2 ways of filing your income tax — paper form (at IRAS or through the mail) and online. The submission due dates are 15 Apr 2019 for the paper form and 18 Apr 2019 for online. Let’s go with online, since almost everyone does things online nowadays.

Here are the documents you should prepare before filing:

- SingPass

- Form IR8A (if your employer isn’t in the Auto-Inclusion Scheme)

- Particulars of family members for tax relief purposes

- Details of all your income

- Business Registration No. / Partnership Tax Ref. No. (for self-employed and partners only)

There are 3 simple steps.

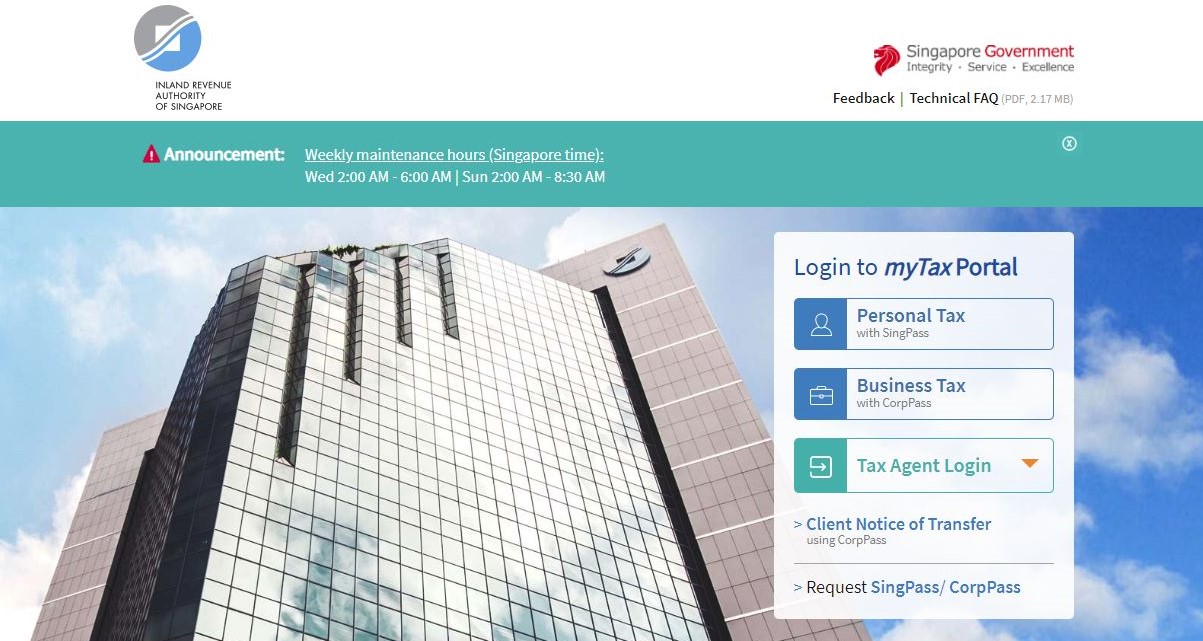

1. Login to myTax Portal using your SingPass

2. Go to “Individuals” tab and click on “File Form B/B1”

3. Fill in your details. These are the most important parts:

- How much you’re earning

- Tax reliefs you’re eligible for

Some of you may find your details already filled in. That’s because your company is under the “Auto-Inclusion Scheme” — the company sends your salary information directly to IRAS. This simplifies the process, so all you’ll have to do is log in and make sure the numbers are correct.

Income tax depends on your salary

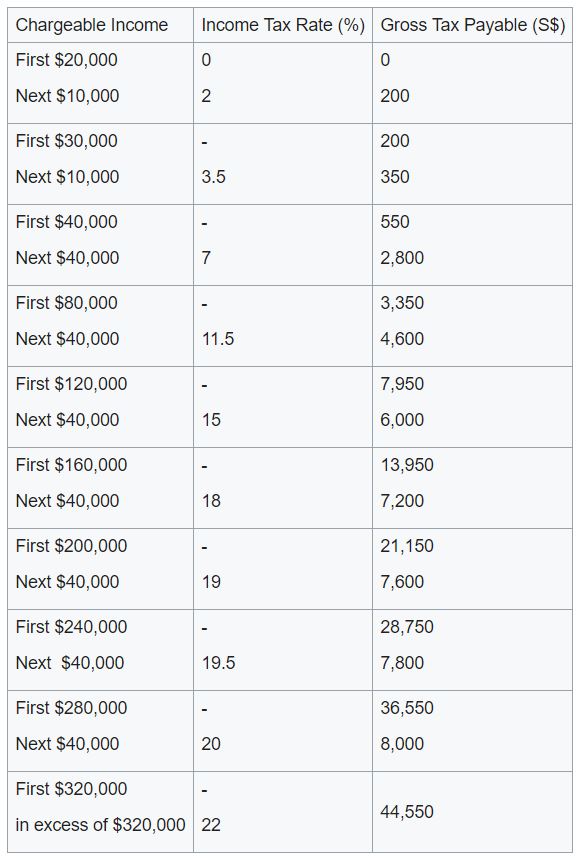

To avoid taxing elderly cai png stall owners the same rate as top-floor investment bankers, IRAS levies different tax rates for different income groups. The more you earn, the higher your income tax.

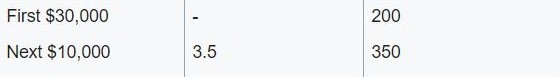

Here’s a table showing you how much you’ll be taxed based on your previous year’s salary.

The table can get confusing, so let’s take an example. Say you earned $25,000 last year, you’ll pay $100 in tax (i.e. 2% of $5,000). If you earned $30,000, you’ll pay $200 (i.e. 2% of $10,000).

Earn more than $30,000, and you get shifted up to the next ‘bracket’. This means every every dollar above $30,000 will be taxed at 3.5% instead of 2%.

For example, earn $35,000 and you’ll pay $375 ($200 + $175). The $175 comes from 3.5% on $5,000.

The higher you go, the higher the tax rate.

Reliefs to pay less tax

Not all of your income is subject to tax. If you’ve been giving some of it to charity or using it to support your parents, you’ll be eligible for something called “tax relief”. Tax reliefs reduce the amount of your income that’s taxable.

The more common tax reliefs include:

- Approved Donations Relief (i.e. donating to a registered charity in the past year)

- $2.50/3 per $1 donated

- Parenthood Tax Rebates

- 1st child — $5,000

- 2nd child — $10,000

- 3rd child — $20,000

- 4th and subsequent — $20,000

- CPF Cash Top-Ups Relief (i.e. putting money into your CPF)

- Up to $14,000

- Parent Relief (i.e. supporting your parents)

- Living together — $9,000 per parent

- Not living together — $5,500 per parent

You can have a look at the full list here.

One important thing to note — the reliefs are deducted from your taxable income, not the amount of tax you have to pay. So for example, if I have a $40,000 salary and 2 children, and I receive the $10,000 relief, only $30,000 of my income will be taxable.

Paying the taxman on time

Don’t panic if you’re on the website and can’t find the option to file your income tax. The forms will only be available from 1 Mar 2019.

Remember, not to miss the deadlines — 15 Apr for paper form submission and 18 Apr for the online form. Otherwise, you’ll find yourself with more letters from IRAS and worse, a monthly penalty fee of 5% on your outstanding taxes. And for every month you delay payment, the penalty increases by 1%.

Better make punctual payments to the taxman!

Featured image from Gov.sg.