MAS Reminds Financial Institutions To Stay Vigilant Against Money Laundering Risks

On Tuesday (15 Aug), the police arrested 10 individuals, aged between 31 and 44, for their suspected involvement in money laundering activities.

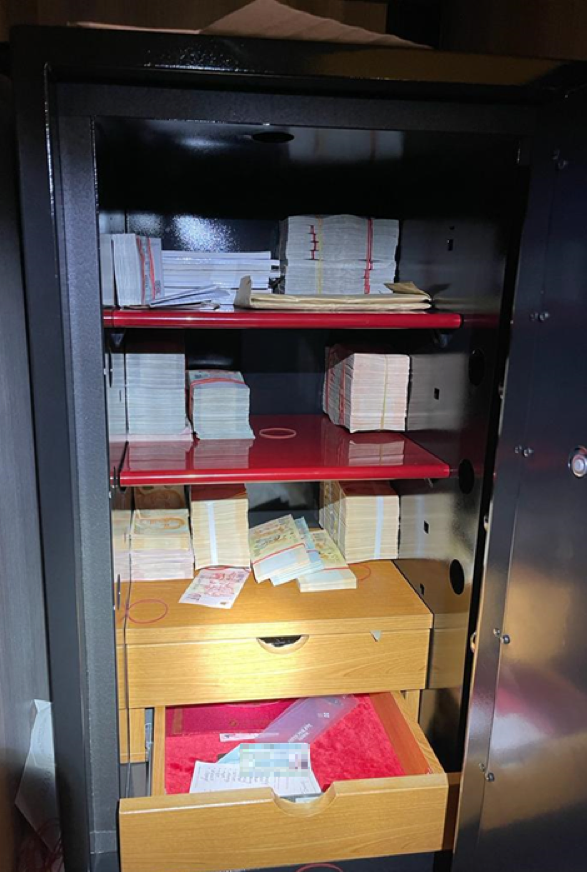

Officers seized a staggering S$1 billion in cash and assets, and investigations are ongoing.

In response to the case, the Monetary Authority of Singapore (MAS) said it takes this incident seriously and has been liaising with financial institutions in Singapore to identify “potentially tainted funds”.

The authority also reminded these institutions to stay vigilant against money laundering risks, stressing that abuse of Singapore’s financial system would not be tolerated.

MAS to take firm action against financial institutions with inadequate safeguards against money laundering

According to a press release by MAS, the arrest of the 10 suspects on 15 Aug resulted from close collaboration between MAS and the Commercial Affairs Department in facilitating developments related to the case.

Both organisations are working closely to track down “potentially tainted funds and assets” that went through financial institutions. Supervisory engagements with these institutions are ongoing.

Cash seized by the police on 15 Aug

Source: Singapore Police Force

MAS said it would take firm action against institutions that have breached the authority’s strict rules on anti-money laundering and countering the financing of terrorism.

Financial institutions with inadequate controls against these risks would also bear the consequences.

Singapore remains vulnerable as a global financial hub

MAS noted that financial institutions in Singapore receive constant reminders to stay vigilant against money laundering and terrorism financing risks. They also must see to it that funds flowing into the country are clean and legitimate.

To ensure robust and effective controls are in place, MAS has also been inspecting financial institutions active in wealth management.

MAS deputy managing director of financial supervision Ms Ho Hern Shin said the money laundering case shows that Singapore remains vulnerable to transnational money laundering and terrorism financing risks.

“MAS and financial institutions need to continue to work together to strengthen our defences against these risks,” she said.

CAD alerted via suspicious transaction reports

The case, revealed by the police on Wednesday (16 Aug) evening, came about after the authorities received financial institutions filed suspicious transaction reports.

SPF’s Commercial Affairs Department were subsequently alerted to attempts of suspicious activities through the financial system.

Some of the red flags they detected were:

- suspicious fund flows

- dubious documentation of wealth sources

- inconsistencies or evasiveness in the information given to financial institutions.

Read more about the case here:

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Google Maps and Singapore Police Force.