Car Owners Share Tips To Save Money Like Evading Parking Fees & Reducing Aircon Usage

Housing prices aren’t the only thing people often gripe about when discussing the cost of living in Singapore – transportation prices, especially car ownership, is a hot topic too.

Getting a licence, buying a car, and dealing with all the subsequent upkeep fees might sound like a financial headache to some.

But it doesn’t have to be that way when you know some nifty hacks. We gathered tips from car owners in Singapore who’ve figured out how to adult while affording their own vehicle.

Here are some money-saving tricks you can try to save precious dollars on your ride.

1. Make parking plans for your trips

The main convenience of having a car is that it can take you to ulu places that may not be accessible via bus or MRT.

However, that doesn’t mean you have to drive to every destination you’d like to go to, especially when parking fees can cost more than your fave bubble tea.

Software engineer Syafiqah Zainuddin, 27, makes it a point to plan her trips, right down to her parking location, to save whatever amount she can.

Source: Anh Tuan To on Unsplash

“When I want to visit the Marina Bay area in the evening, I’ll usually park at Suntec City as they charge a per entry rate after 5pm,” she explained.

“From there, malls and attractions like the Esplanade and Marina Bay Sands (MBS) are within a decent walking distance, so there’s no need to drive.”

If she has to venture a little further, Syafiqah doesn’t mind taking the MRT or bus from one or two stops away.

This helps beat the stress of finding parking space, she explained, particularly on weekends when everyone in Singapore seems to be out and about.

Besides, she can sit and sip on coffee at a different mall without worrying about her parking fee rising every hour or part thereof.

2. Stop treating your car like a storage space

What Serene Chan, 40, means by this is that you should reduce or remove non-essential items in your car to reduce its weight.

Source: Cycle & Carriage

The senior marketing manager believes that more weight equals more petrol consumed when travelling, so she took out all the junk she used to store in the car, such as bags, shoes, clothes, and even a pram.

“My husband used to teach me some basic physics, so generally speaking, more mass requires more power to accelerate.

“I’m sure cars these days are quite innovative and high-tech, so I’m not sure if this principle still holds. But I guess it makes us feel better about ourselves when it comes to fuel economy,” Chan said.

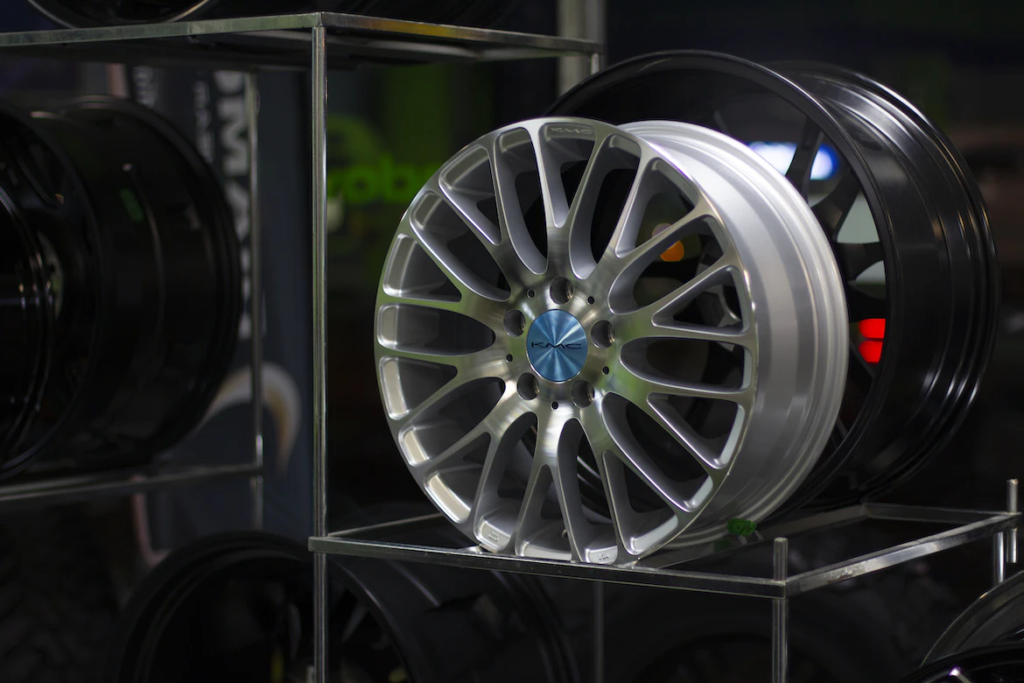

3. Source for car parts online

Though leaving your car parked in one spot for a long time implies that you don’t get to show it off much, that doesn’t mean you shouldn’t spruce it up a little bit.

Experts at the workshop may recommend the best car parts, but those often entail rather staggering prices.

Source: @koolcreation on Unsplash

Like those affordable yet classy clothes you bought online, you can also find cheaper but equally sturdy car parts on e-commerce websites.

Business owner Fariz, who has owned multiple cars over the past 40 years, is certainly thankful for online shopping platforms, where he has recently been sourcing accessories.

“I can get anything from window shades to car rims and body kits at a fraction of the price that workshops offer. It’s a lot easier to choose what I like and customise my car according to my preferences,” said the 59-year-old.

Of course, you’d still have to pay a mechanic to install certain parts, but you’d save a significant amount on the products themselves.

4. Don’t wash your car if you know it’s going to rain

Once your car looks sleek, you’d want to ensure that it’s always clean, so regular washes are essential.

Just check the weather before you do that, as rainfall after you’ve polished the car is not ideal.

Business analyst Jay Cheng, 35, learnt this the hard way when he found unsightly spots across his vehicle after driving his cleaned car in the rain several times.

Source: Kevin Woblick on Unsplash

After the weather washed away all his effort and money, Jay had to painfully clean the car all over again, which cost him nearly double what he put in.

“Now, I make it a point to check the weather forecast before I decide to wash my car. Sure, it’s not always accurate, but I’d rather be safe than sorry,” he related.

5. Stick to your routine maintenance

While forking out money to maintain your car regularly sounds counter-intuitive initially, it will spare you from unnecessarily high costs – and inconvenience – in the long run.

Source: Tim Mossholder on Unsplash

Teacher Simon Chong, 55, stands by this. He said skipping routine maintenance runs the risk of getting into accidents because the driver isn’t aware their vehicle is unsafe.

“Ironically, paying for maintenance isn’t money you should save because the trouble you could save from doing that is worth so much more.

“We’re all busy people, and we all have places to get to. So whatever trouble we can minimise on our end, we do it,” he said.

Alternatively, you can also consider Googling or asking someone in the know to learn basic DIY maintenance skills, such as:

- Changing air filter

- Checking car battery, fluid levels, and tyre condition

- Learning to repair the exhaust

That way, you won’t have to spend much at all.

6. Don’t leave your car engine running while waiting or idling

Many car owners are probably guilty of leaving the engine running without moving at some point. Because sometimes, the person they’re waiting for is late, or the weather is unbearably hot.

But know that your petrol is guzzling away if you keep the engine running while staying stationary, which means your next visit to the petrol station could come earlier than expected.

The same goes for warming up your car before driving, which has been described as an outdated practice. Mechanic Sim Boon Meng, 40, notes that the engine warms up faster when you drive your car.

“So don’t turn on the engine and leave your car there. You’re just wasting petrol. Driving your car right away will get the temperature up faster,” he said.

7. Use a good petrol credit card

Since we’re on the topic of petrol, there are better ways for car owners to acquire some savings, which come in the form of petrol credit cards.

Sales associate Kevin Seah, 30, said the best way around this is to look online for the best petrol promotions and credit card deals.

Seah, who frequents Esso, has chosen a credit card that best suits his needs and spending habits. He now gets at least 18% fuel discounts with each pump.

“Just be sure to look out for the card’s T&Cs, such as minimum spend, so that you’re eligible for what you signed up for,” he reminded.

Some websites recommended by users online include FuelKaki and MoneySmart.

8. Sign up for the right car insurance like Singtel Car Protect

Every driver knows that getting into an accident is expensive. Since car insurance is compulsory in Singapore, the key is to find one that gives you the necessary coverage and benefits so that you can be fully prepared for the worst.

Singtel Car Protect has a high personal accident coverage of up to S$120,000 for car owners and S$50,000 for their passengers.

Source: Singtel

Some plans even let you get repairs done at your preferred workshop. But when you visit one that’s authorised by Great Eastern, you’ll get a waiver of up to S$500 of the repair excess on your first claim.

If you’re reading this and thinking of switching to a car insurance plan with a competitive price and good value for money, check out the Singtel Car Protect plan here.

Plans start from just S$600, and once you’ve signed up, you’ll get S$300 petrol vouchers as a welcome perk. So for the next few weeks or so, petrol costs would be the last thing you’d worry about.

What’s more, Singtel customers who sign up for a plan from 3 Oct to 31 Dec 2022 can get an extra 10% off their premium. Click here to find out more.

Being smart & budget-conscious pays

Be it unusually practical or downright weird, it’s no secret that budget-conscious car owners are constantly looking for ways to stretch their dollar.

Having a car makes life a lot more convenient. But this ownership comes with some added responsibilities and costs.

As a motorist, there are simple habits you can pick up that will make a big difference in your daily or monthly expenses. You just need to know how and where to start.

This post was brought to you in collaboration with Singtel.

Featured image adapted from TheSmartLocal and Cycle & Carriage.