DBS Bank Cuts Interest Rates For Multiplier Account & PayLah

2020 hasn’t been a kind year to many, especially when the pandemic outbreak brought tough financial days ahead.

Many businesses have taken a hit. This then followed by local banks such as OCBC and UOB lowering their interest rates in June.

Now, DBS has announced their 3rd cut since May this year, as they will be slashing rates on saving accounts from 1 Jan 2021.

The famous bunny of DBS Multiplier

The famous bunny of DBS Multiplier

Source

Based on their latest round of revision, rates could be slashed by up to 0.9% when it comes to crediting one’s salary and making transactions in 4 eligible categories:

- Credit card

- Home loan

- Insurance

- Investment

Meanwhile, spending under their payment app PayLah will be cut by 0.1%.

Rates cut by up to 0.9% for DBS Multiplier

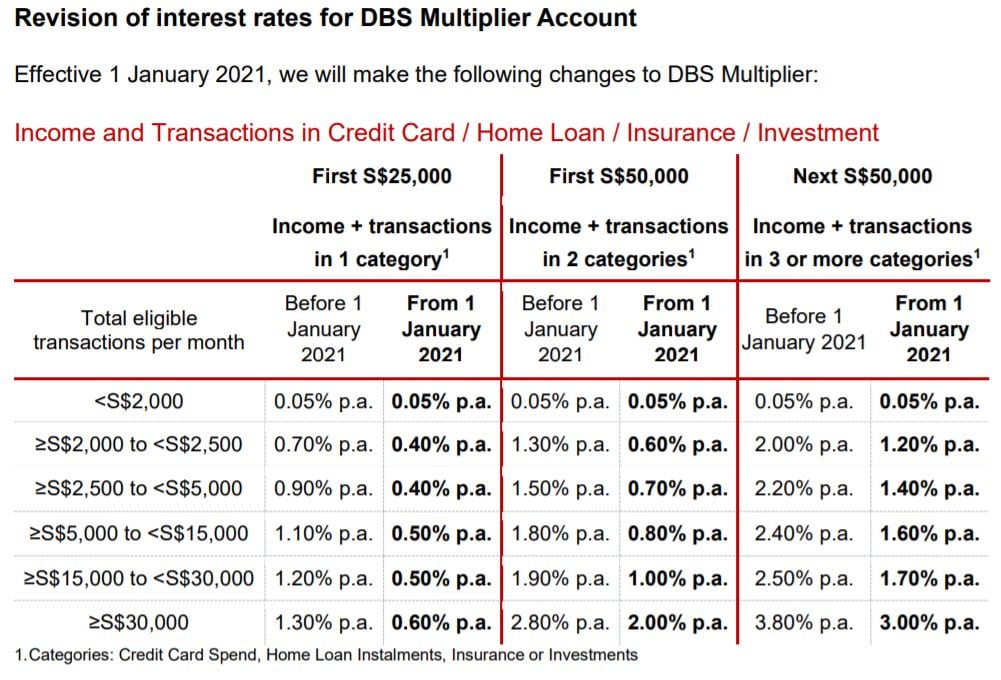

For those holding DBS Multiplier account, the income and transactions are split into 3 tiers:

- Tier 1: First $25,000 (income + transactions in 1 category)

- Tier 2: First $50,000 (income + transactions in 2 categories)

- Tier 3: Next $50,000 (income + transactions in 3 categories and above)

According to DBS, rates will go down by up to 0.7% in tier 1, up to 0.9% in tier 2, and up to 0.8% in tier 3.

Here’s a breakdown of the cuts in a table.

0.1% slash for PayLah transactions above $500

Even though there will be changes to PayLah interest rates, thankfully, the cuts aren’t as significant.

If you’re below 29 with no eligible income, good news — there won’t be any changes to the current 0.3% rate. Just make a transaction at your nearest mall, and you’ll get the 0.3% bonus right away.

But things are different for those under the income credit and PayLah retail spend option. Transactions of more at $500 will give you a 0.4% rate, down 0.1% from the current 0.5% bonus.

Transactions of up to $500 will remain at 0.05%.

Expanding more options to save money is the way to go now

As with most saving accounts, interest rates are expected to be higher if you’re spending in larger amounts with DBS.

Unfortunately, many account holders will be disappointed by this latest cut. Though given the current economical situation, such exercises are understandable.

You can either wait till things get better, or learn to be more financially savvy and expand ways of how you can save more.

Have news you must share? Get in touch with us via email at hello@mustsharenews.com.

Featured image adapted from DBS and My Sweet Retirement.

Drop us your email so you won't miss the latest news.