Singapore Might Have Lower Tax Burden But We Pay More Elsewhere, Says Jamus Lim

Workers’ Party MP Associate Professor Jamus Lim has pointed out that even though Singapore has a ‘lower tax burden’, there are many hidden costs and tradeoffs Singaporeans have to pay.

They don’t need to pay as much to have an efficient public service but feel aggrieved regardless, as they still pay in various other ways, like time and costs incurred elsewhere.

This, he noted, creates a system that “can feel stacked” against the less fortunate and middle class, as well as puts citizens under constant pressure to decide on what to pay for.

Jamus Lim points out Singaporeans pay for lower tax burden in other ways

In his Facebook post on Monday (27 Feb), Assoc Prof Lim responded to Deputy Prime Minister Lawrence Wong’s claim that Singaporeans have a lower tax burden compared to other countries.

If we want to pay less on taxes, we’ll either have to accept lower quality, or less coverage, or longer waits. Some of it may be offset by high efficiency, but such gains can only go so far. Or we pay, through other means.

He gave an example where even though we have “world-class educational outcomes” while paying low taxes, we make up for it via private tuition spending because of larger classes.

Another example is our public healthcare system, which requires patients to wait for long periods for treatment despite having “some of the best equipment and amazing doctors”.

Assoc Prof Lim also claimed our social security system cuts families off at unbearably low levels of income.

Source: Facebook

Paying through other fees

“We also pay via fees and charges, both real and hidden,” Assoc Prof Lim continued. “We have among the most sophisticated systems in the world for charging for road usage, and owning a car is 3 to 4 times more expensive than elsewhere in the world.”

Paying for an HDB flat also includes land costs, which can get inflated and add to the cost of living, which is “already unbearable”.

“HDB grants offset some of this burden, but it’s unclear whether these go disproportionately toward those who need help the most,” he said.

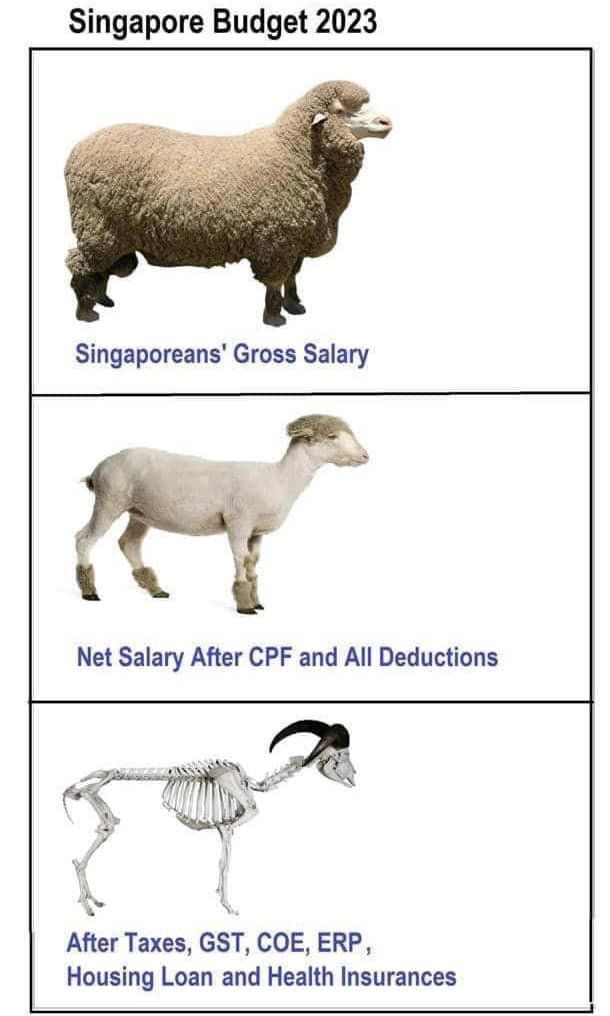

Singaporeans intuitively understand this, he added, which is why there was a meme about how salaries are stripped significantly after Budget 2023.

The meme shows Singaporeans’ concern over the various costs that Singaporeans pay. He then questioned if this approach of paying lower taxes is better.

“After all, this approach means that those who actually use public goods and services more end up paying more. It is, undeniably, more efficient. But is it fair or just?”

“We are constantly being ‘tested’ on our choices, and expend cognitive energy figuring out whether we want to drive/park at this time or not, to choose this health plan or that, or which subjects merit extra tuition,” he added.

I’m not saying that we shouldn’t be mindful about how we spend our money. All I’m saying is that, truly, there isn’t any free lunch.

He said Singapore can’t really claim that it has a low tax burden and therefore we must be well off, when we’re also being squeezed in so many other ways.

Singaporeans have to decide if they want more tax or less tax

Concluding, Assoc Prof Lim said Singapore has to decide whether it wants a low-tax regime with more indirect costs, or a higher-tax one but which the government can spend in more progressive ways.

“Regardless, the most important thing is to be clear-eyed about the realities of what tradeoffs are being made, so that we can be more informed when we engage in public policy debates,” he finished.

Difficult to implement other forms of taxation: DPM Wong

DPM Wong had said in Parliament on Friday (24 Feb) that Singapore has to proceed with a raise in Goods and Services Tax (GST) in 2024 on top of the 1% raise this year.

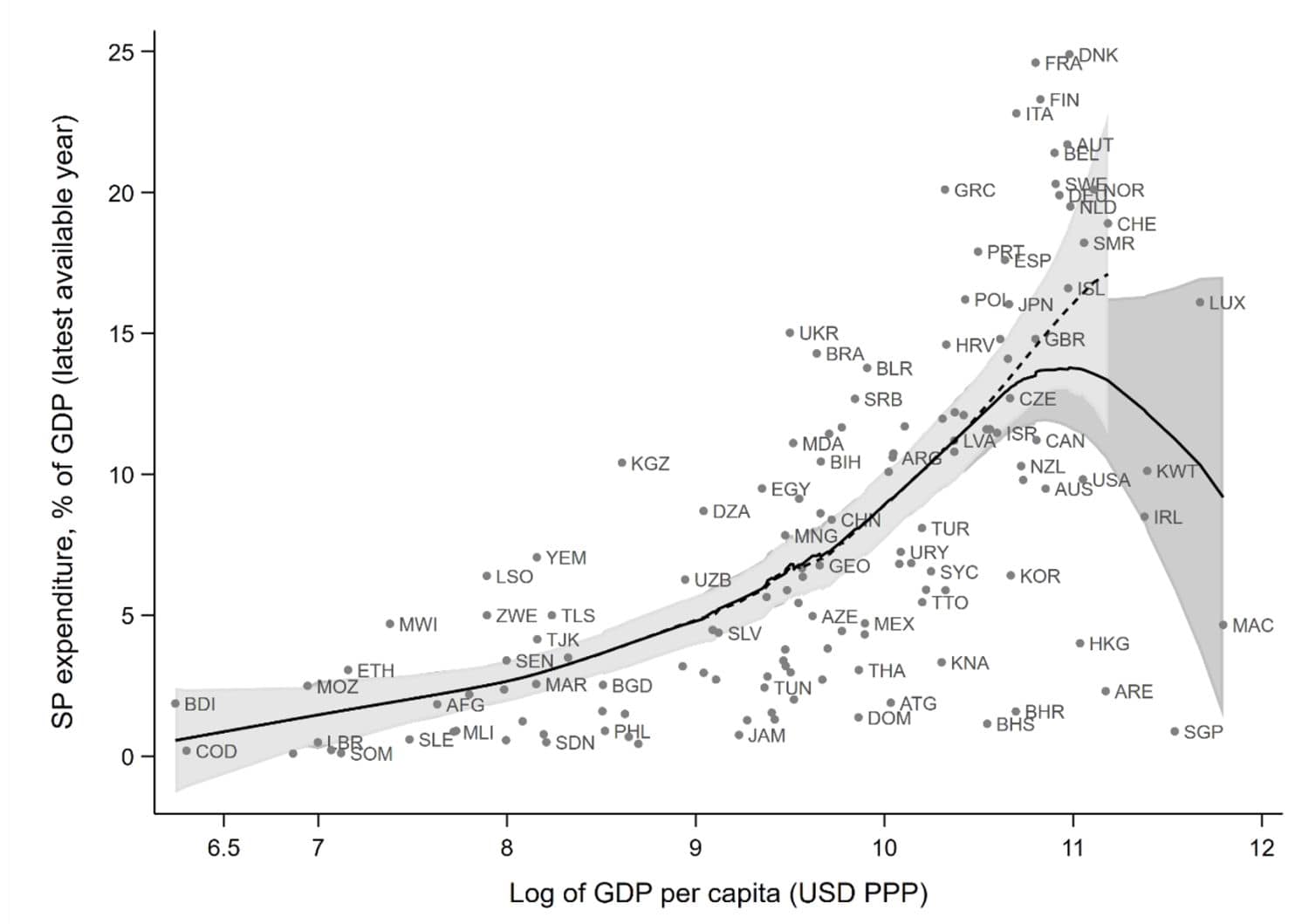

But he pointed out that Singapore’s tax-to-GDP ratio was “considerably lower” than developed economies, at 14%.

Other forms of taxation suggested by WP and the Progress Singapore Party (PSP), such as wealth taxes, corporate tax and land sales revenue, would struggle to raise enough money for future spending, he said.

“Contrary to what (WP) believes, we will need all of them, and a mix of taxes on income, consumption and assets, to provide sound and stable public finances in Singapore,” DPM Wong noted.

He also said later that “as consumers, all of us must be prepared to pay more for services delivered by our fellow Singaporeans.”

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from xegxef on Pixabay.