OCBC Raises Interest Rate On 360 Savings Account To 4.65% A Year On First S$100,000 In Account

Singapore’s banks have recently been luring customers with high interest rates.

OCBC Bank has now upped the ante by raising the interest rate on their 360 Savings Account for the second time this year.

Source: Google Maps

There will be no change in criteria for customers to enjoy the boost.

Interest rate on OCBC 360 Account revised from 1 Nov

In a notice on Monday (31 Oct), OCBC said the interest rate for their 360 Account would be revised from Tuesday (1 Nov).

It will go up to 4.65% yearly, a significant jump from the current 1.85%, reported by The Straits Times (ST).

This will be counted for the first $100,000 in customers’ bank accounts.

Three criteria to be eligible

As per usual, customers will have to fulfil specific criteria:

- Credit at least S$1,800 in salary via GIRO

- Save at least S$500 per month in their account

- Spend at least S$500 on selected OCBC credit cards a month

The bank said that these criteria remain unchanged and can be met through most customers’ everyday actions.

Customers will also see their interest soar even higher – to 7.65% a year, from 4.05% – if they make investments and buy insurance through OCBC.

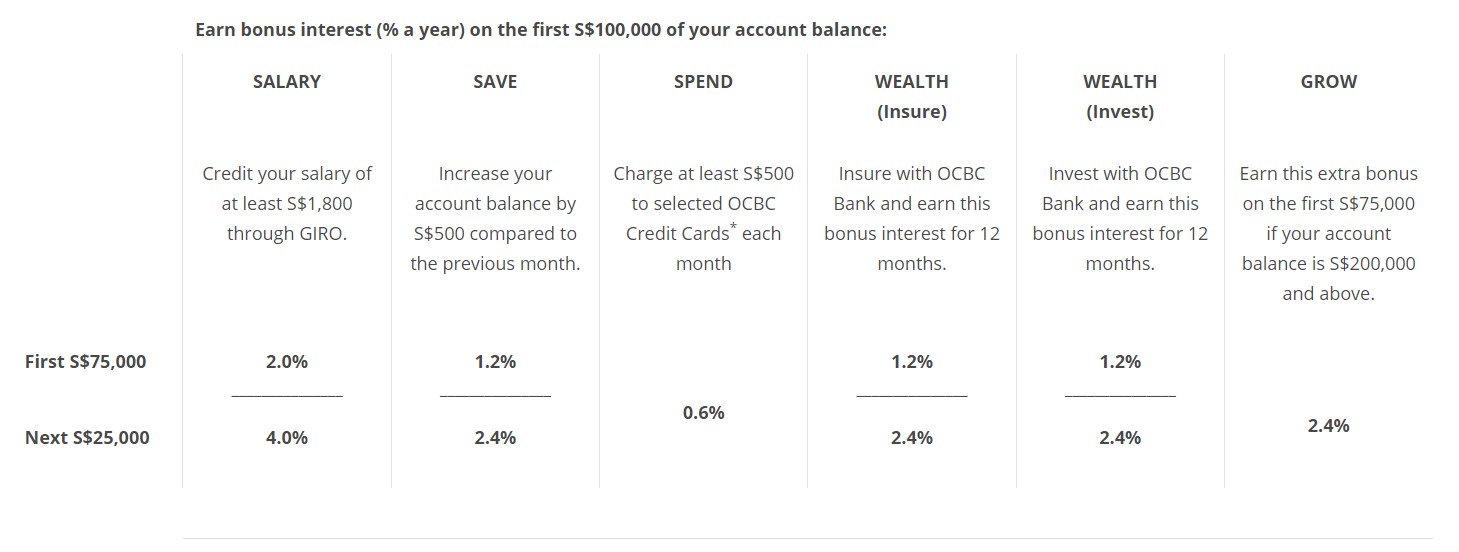

Here’s a summary of all the criteria and bonus interest that may be earned:

Source: OCBC

More credit cards will be eligible

OCBC is also allowing more of their credit cards to be eligible in the “spend” category.

From 1 Nov, an expenditure of at least S$500 on the following cards will fulfil the criteria:

- OCBC 365 Credit Card

- OCBC Titanium Rewards Credit Card

- OCBC 90°N Visa Card

- OCBC 90°N Mastercard

Source: rupixen.com on Unsplash

Previously, only spending on OCBC 365 cards was eligible.

About two-thirds of 360 Account holders eligible for credit cards already have one of the above cards, ST reported.

OCBC raises interest rate a second time in 2022

In September, OCBC raised the 360 Account interest rate to 4.05% yearly on the first S$100,000.

Thus, this is the second time the bank is doing so this year, as well as the second time in just two months.

They join many other local banks in raising interest rates as they compete for customers’ deposits.

This led to long queues of Singaporeans eager to avail themselves of high-interest-rate promotions.

Long Queues At S’pore Banks Due To High Interest Rates, Up To 4 Hours’ Wait

With OCBC’s latest move, it remains to be seen which bank will win out.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Google Maps.

Drop us your email so you won't miss the latest news.