Singapore Announces New Property Cooling Measures, ABSD Increases For Residential Purchases

Amidst rising housing prices in Singapore, the government has announced a new round of property cooling measures.

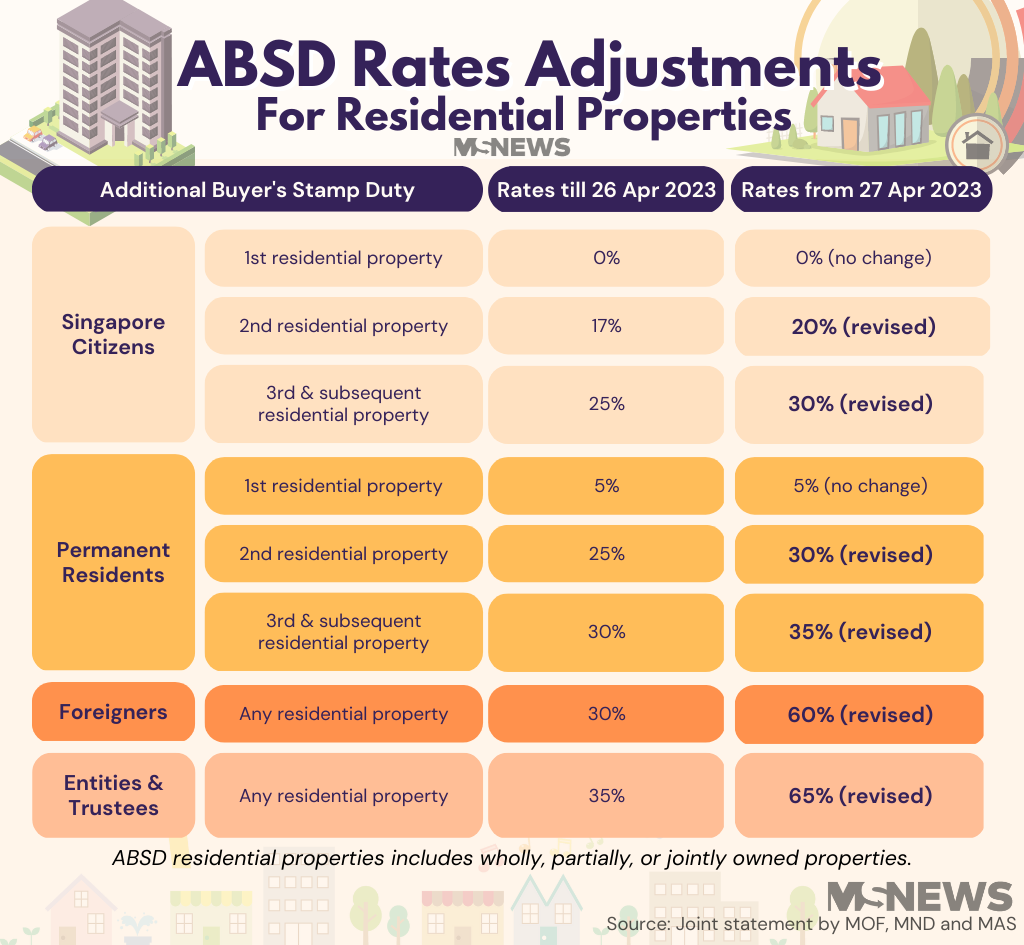

From today (27 Apr), the Additional Buyer’s Stamp Duty (ABSD) rate will double for foreigners purchasing residential properties here.

The ABSD, PropertyGuru explains, is a tax that may be levied on top of the existing Buyer’s Stamp Duty (BSD), which applies to all property purchases in Singapore.

Source: Xrdes on Unsplash, for illustration purposes only

There will also be a slight increase in ABSD rates for Singapore citizens and permanent residents (PRs) buying their second residential property.

The government noted that these steps are in place “to promote a sustainable property market”.

Previous property market measures had ‘moderating effect’

The Ministry of National Development, Ministry of Finance, and Monetary Authority of Singapore announced the new property cooling measures via a joint press release on Wednesday (26 Apr).

They noted that the previous property market measures implemented in December 2021 and September 2022 had “a moderating effect”.

However, property prices still showed “renewed signs of acceleration amid resilient demand” in the first quarter of 2023.

In addition to strong demand from Singaporeans buying homes for owner-occupation, both local and foreign investors alike have displayed renewed interest in the residential property market.

The government warned,

If left unchecked, prices could run ahead of economic fundamentals, with the risk of a sustained increase in prices relative to incomes.

Thus, the latest measures aim to promote a sustainable property market, dampen investment demand, and prioritise housing for locals buying for owner-occupation.

Higher ABSD rates for locals & foreigners

As part of the new measures, there will be a hike in ABSD rates for the following groups:

- Singapore citizens buying their second residential property — from 17% to 20%

- Singapore citizens buying their third and subsequent residential property — 25% to 30%

- PRs buying their second residential property — 25% to 30%

- PRs buying their third and subsequent residential property — 30% to 35%

- Foreigners buying any residential property — 30% to 60%

- Entities or trusts purchasing any residential property, excluding housing developers — 35% to 65%

There is no change to the ABSD rates for Singapore citizens and PRs purchasing their first residential property. They will remain at 0% and 5%, respectively.

According to data from last year, these groups make up around 90% of residential property transactions.

The new rates come into effect for all residential properties acquired on or after today (27 Apr). The government said,

The revisions to the ABSD rates to help moderate investment demand will complement our efforts to ramp up supply, to alleviate the tight housing market for both owner-occupation and rental.

Additionally, there will be a transitional provision where the ABSD rates on or before 26 Apr will apply to cases that fulfil all these conditions:

- The Option to Purchase (OTP) was granted by sellers to potential buyers on or before 26 Apr 2023

- This OTP is exercised on or before 17 May 2023 or within the OTP validity period, whichever is earlier

- This OTP has not been varied on or after 27 Apr 2023

Married couples with at least one Singapore citizen can apply for ABSD refund

Married couples who jointly purchase a second residential property may continue to apply for a refund of the ABSD as long as at least one spouse is a Singapore citizen.

This is subject to the condition that they sell their first residential property within six months after the date of purchase of their second residential property if it has already been completed.

If it hasn’t been completed, then they must sell the first property within six months after the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of their second residential property, whichever is earlier.

Source: Kelvin Zyteng on Unsplash, for illustration purposes only

Those purchasing an HDB flat or Executive Condominium unit from housing developers with an upfront remission are not affected by the ABSD if any of the joint acquirers or purchasers is a Singapore citizen.

Government preparing to launch up to 100,000 new flats by 2025

Acknowledging that the Covid-19 pandemic had caused serious delays to both private and public housing projects, the government stated that it has “made good progress to get back on track”.

It added that “there will be significant housing supply coming onstream over the next few years”.

For instance, nearly 40,000 public and private residential property completions will be completed this year. Almost 100,000 units are expected to be completed by 2025 as well.

After launching over 23,000 flats in 2022, there will be another 23,000 launched in 2023.

“We are also prepared to launch up to 100,000 new flats in total between 2021 to 2025,” the government said. “We will continue to maintain a steady pipeline, to cater to growing housing demand.”

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Fleur Kaan on Unsplash for illustration purposes only.