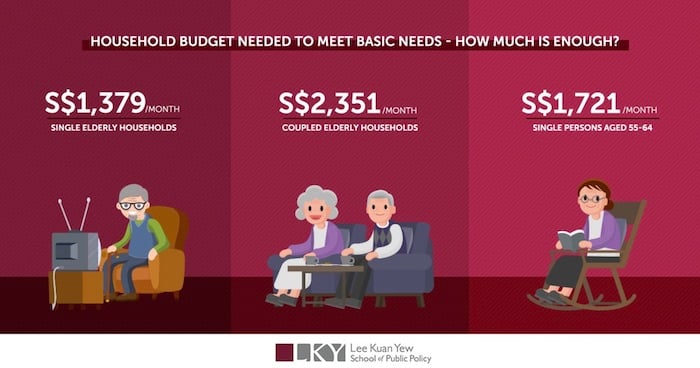

NUS Study Found That Elderly S’poreans Need At Least $1,379 Monthly To Meet Basic Needs

How much do you need to comfortably retire?

A group of researchers led by Assistant Professor Ng Kok Hoe – from the Lee Kuan Yew School of Public Policy (LKYPP) and National University of Singapore (NUS) – were determined to find out.

The researchers conducted focus group discussions with more than 100 participants from different backgrounds. Participants were asked to come to an agreement about the items and services classified as basic needs — to determine the minimum acceptable standard of living in Singapore.

A media release (23 May) revealed that single elderly households must have a minimum of $1,379 per month to get by.

Minimum of $1,379 per month

The study found that the household budgets needed to meet basic needs are:

The budget is based on a list of items that participants classified as basic needs. It includes products and services such as a 2-room HDB flat, healthcare, food and clothing.

When participants reached a consensus and classified an item as a need, it ended up in the monthly budget calculation.

Dr Ng said in the press release,

This study reveals that ordinary members of society can come to a consensus about a basic standard of living in light of norms and experiences in contemporary Singapore.

CPF payouts in Singapore

Most working Singaporeans set aside a percentage of their income towards their CPF (Central Provident Fund).

The CPF (Central Provident Fund) may be used to save money for retirement.

All Singaporeans and permanent residents have two types of CPF accounts:

- Ordinary Account (OA) – Used to pay for housing, education and investments.

- Special Account (SA) – Used to pay for some investments.

When Singaporeans reach the age of 55, these accounts will merge to form their retirement account. Recipients will receive monthly payouts for as long as they live.

CPF payouts not enough to meet basic needs

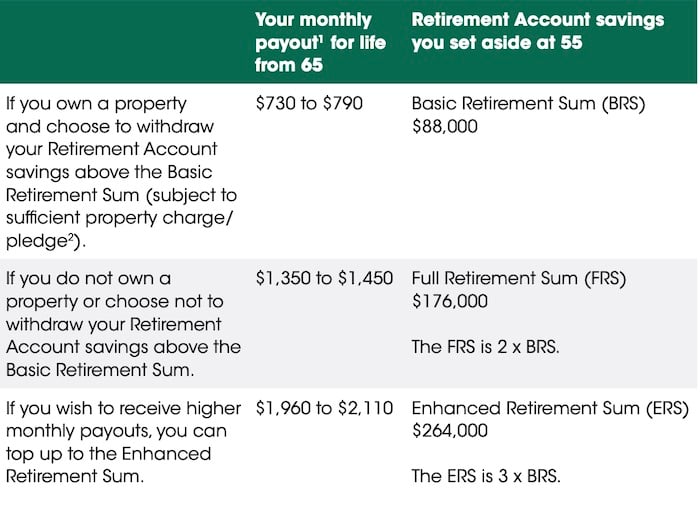

Singaporeans can start to receive payouts from the age of 55.

Recipients from the Basic Retirement Sum (BRS) tier used their CPF to own a property. At $730 to $790, their CPF meets only half of the amount required to meet their basic needs.

Those in the Full Retirement Sum tier receive $1,350 to $1,450 per month. This amount is only enough to cover their minimum basic necessities.

Here’s a table that shows the monthly payouts elderly Singaporeans can receive:

Saving for retirement

The Department of Statistics states that the current life expectancy for locals is 82.8 years.

The Full Retirement Sum is only enough to buy the items that recipients need the most and we don’t think that includes foreign trips to Bangkok or taking trips to Sentosa. More importantly, you won’t be able to survive with the basic monthly tier.

Furthermore, The Straits Times reported that those that want to be in the top 20% and enjoy their retirement will need about $4,120 a month.

As cost of living and life expectancy increases, we can only hope that younger Singaporeans have contingency plans to prepare for the retirement that they envisioned.

Featured image from Facebook.