Singapore Increases Tobacco Tax By 15%, Will Generate S$100 Million More Revenue

In a bid to discourage residents from consuming tobacco products, Singapore will be implementing a 15% increase in tobacco tax from today (14 Feb).

The increase will reportedly affect all tobacco products and is expected to generate about S$100 million of additional revenue per year.

Source: Facebook

The last tax hike was during Budget 2018 when the Government increased the tobacco tax by 10%.

Tobacco tax increase begins 14 Feb

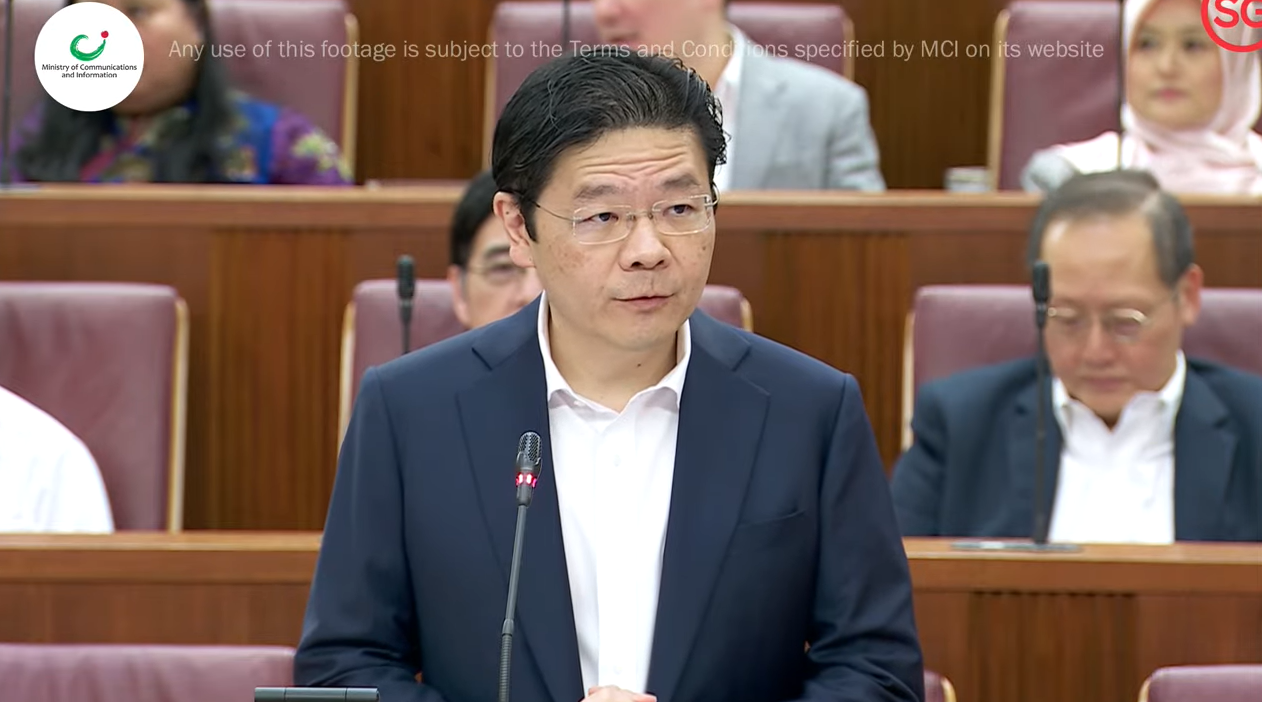

During the Budget 2023 speech on Tuesday (14 Feb), Finance Minister Lawrence Wong introduced adjustments to Singapore’s tax system.

Source: MCI Singapore on YouTube

Besides changes to Buyer’s Stamp Duty and Additional Conveyance Duties, he also announced a 15% increase in tobacco excise duty.

The increase will take effect today (14 Feb) and will impact all tobacco products.

Explaining the move, Mr Wong said it was part of Government efforts to discourage the consumption of tobacco products.

According to The Business Times, the move will likely generate an additional S$100 million in Government revenue each year.

Towards a smoke-free Singapore

The news is certainly not a welcome change for smokers, who are already facing various other restrictions.

However, it will be welcomed by many others who envision a smoke-free Singapore.

Nevertheless, those who may still be buying cigarettes often should take note of the price increase as a result of the tax hike.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Jonathan Kemper on Unsplash.

Drop us your email so you won't miss the latest news.