UOB Raises Maximum Interest Rate From 3.6% To 7.8% For One Account

2022 has been a ‘battlefield’ for local banks that are trying to edge out their competitors by offering higher interest rates.

On Thursday (1 Dec), UOB raised the maximum bonus interest rate on their One Account from 3.6% to 7.8% per year, adding more competition to the personal banking scene.

Source: Capitaland

With the change, UOB now has the highest maximum bonus interest rates among the three local banks.

7.8% interest rate for deposits above S$75,000

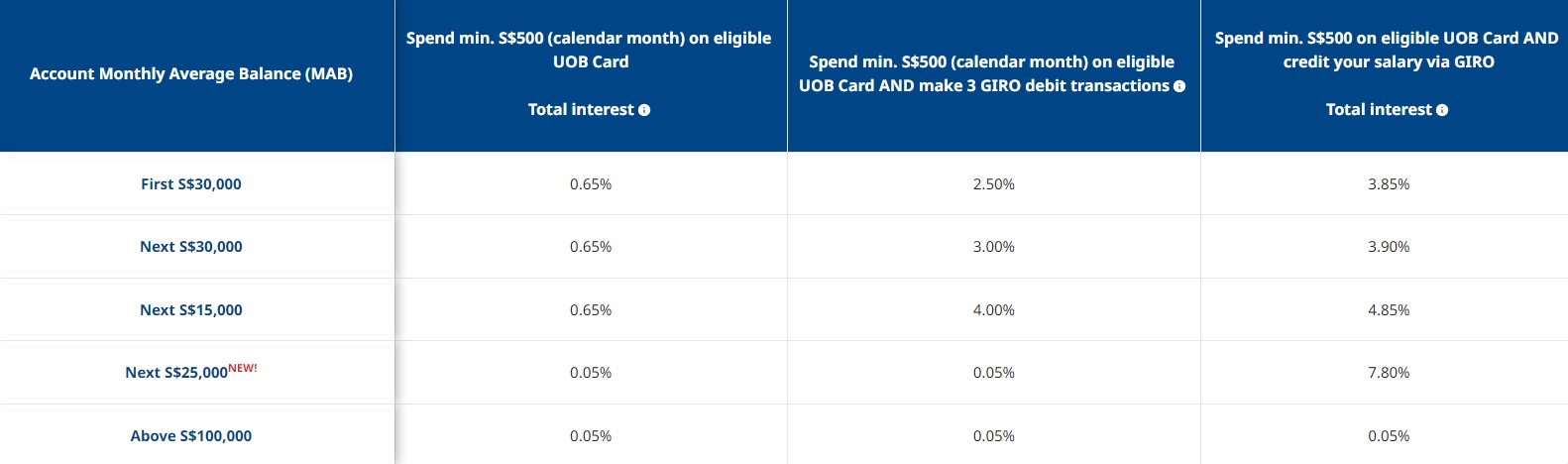

From Thursday (1 Dec), UOB is offering up to 7.8% interest rate on their One Account. This is up from the previous bonus interest rate of 3.6%.

The 7.8% interest rate applies to customers who meet the following criteria:

- Account monthly average balance between S$75,000 and S$100,000

- Spend a minimum of S$500 on an eligible UOB card

- Credit salary of at least S$1,600 into the account via GIRO

Currently, the tiered bonus interest rates for balances up to S$75,000 range from 3.85% to 4.85% per year. This is up from the previous 1.4% to 2.5%.

Source: UOB

According to The Straits Times (ST), the new bonus rates are the highest in One Account’s seven-year history.

Highest maximum bonus interest rates among local banks

This latest interest rate hike puts UOB ahead of the two other local banks — OCBC and DBS.

OCBC’s 360 Account offers up to 4.65% a year for customers’ first S$100,000.

However, customers will have to fulfil these requirements:

- Spend a minimum of S$500 on eligible OCBC credit cards

- Credit salary of at least S$1,800 into the account via GIRO

- Increase account balance by at least S$500 a month

If customers also invest and buy insurance through the bank, they can secure an interest rate of up to 7.65%.

As for DBS, their Multiplier Account has a maximum interest rate of 4.1% per year for the first S$100,000.

To get the bonus interest rate, customers will have to do the following:

- Credit an income stream

- Transact in three categories with a total volume of S$30,000 or more in eligible monthly transaction

These rates also increase if customers spend larger amounts.

This includes spending with DBS or POSB credit cards, mortgage payments, as well as investments.

Both DBS and OCBC had made two revisions of their savings account interest rates following the Federal Reserve’s rate hikes to control runaway inflation.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Capitaland.