Young Couple Purchases S$1.2 Million Condo Unit After Saving For 3 Years

With rising property prices in Singapore, it can be scary for someone who is not even in their 30s to even think about buying a house.

However, a young couple in Singapore managed to do the impossible — they bought a million-dollar condominium unit after saving up for three years.

They shared their experience on the social media platform Lemon8 and explained how they financed their big purchase.

Their strategy included using their Central Provident Fund (CPF), taking out loans, and good ol’ penny-pinching.

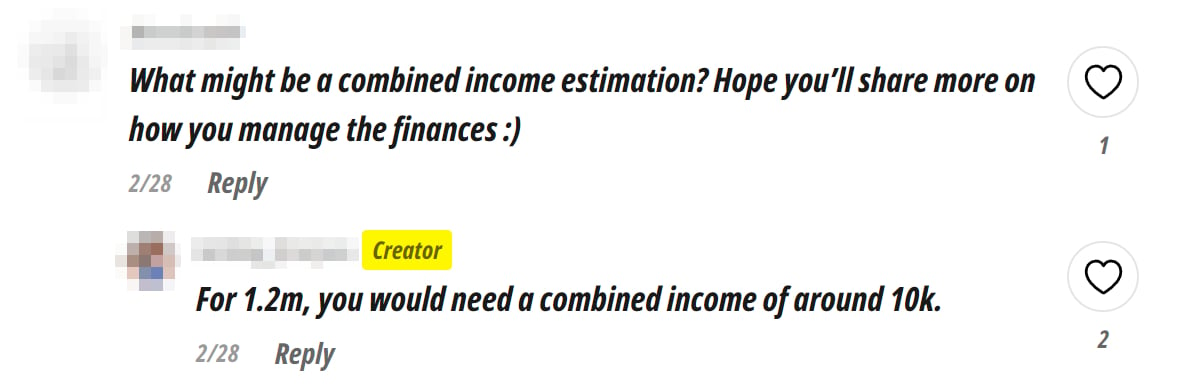

S$1.2 million condo unit required combined income of S$10,000

The couple first shared their story on Lemon8 on 27 Feb.

The video included a simple walk-through of the couple’s new home, starting at the entrance of the condo and going through the ground floor.

Source: Lemon8

Then, the couple revealed their apartment as they rolled a pineapple into the living area as per Chinese tradition.

Upon entering the unit, a small but functional kitchen greets viewers on the left side.

Meanwhile, the living room lies beyond the kitchen space — the former furnished with a sofa, television, and a console.

Source: Lemon8

Additionally, the couple’s new space comes with an attached balcony that overlooks the pool.

As it turns out, the condo is a two-bedroom and two-bathroom unit, which they reportedly paid S$1.2 million for.

Source: Lemon8

They added that in order to afford it, a couple would need a combined income of around S$10,000.

Saved & planned for 3 years to cover downpayment

Apart from the house tour, the couple revealed the details of how they financed the huge purchase.

They broke down the costs into two main chunks: the 25% down payment and the monthly repayments of between S$4,000 and S$4,500.

For the latter, the pair said that they only have to pay less than S$1,000 each month in cash payments since their CPF covers most of it.

Meanwhile, their downpayment and buyer’s stamp duty cost them up to S$350,000.

While they paid half of it with CPF, they still each had to save S$2,000 a month for three whole years to afford it.

Couple in Singapore buys condo with own money

For the couple, buying a condo was simply a matter of personal preference.

Regardless of what type of property they had purchased, the pair is living proof that you can achieve whatever you set your mind to.

All you need is a solid plan and a willingness to work towards your goal over a long period of time.

Kudos to both of them for purchasing their first home with their hard-earned money.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Lemon8.