Most Singaporeans can transfer excess funds to CPF Retirement Account after closure of Special Account

From early 2025, Central Provident Fund (CPF) members aged 55 and above will no longer have a CPF Special Account (SA). Instead, most Singaporeans will be able to transfer excess funds from their SA to their Retirement Account (RA).

They can also transfer their Ordinary Account (OA) savings to the RA, up to the Enhanced Retirement Sum (ERS).

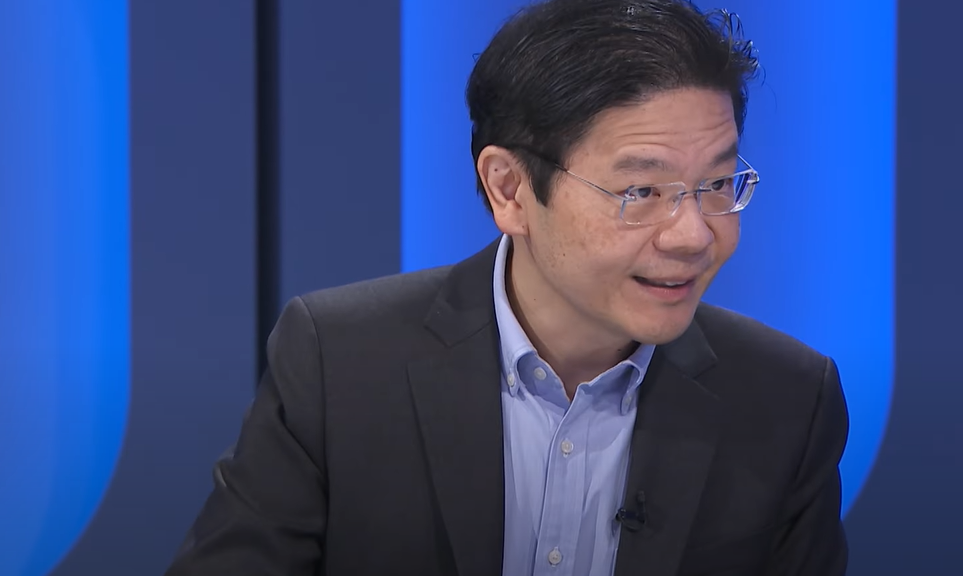

In an interview on Channel NewsAsia’s (CNA) ‘Ask the Finance Minister’, Deputy Prime Minister (DPM) and Finance Minister Lawrence Wong stressed that the closure of the SA aligns with CPF’s objectives.

CPF Special Account will close from 2025 for users 55 & above

During Budget 2024 last Friday (16 Feb), DPM Wong announced that the CPF Special Account (SA) will be closed with effect from 2025.

Source: Channel NewsAsia on Youtube

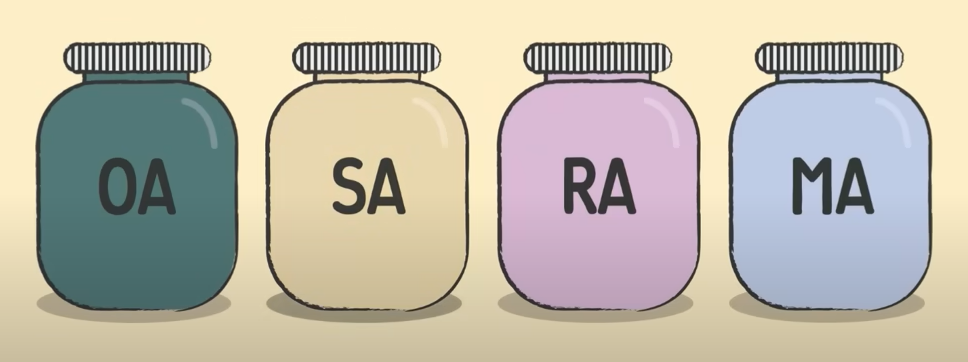

At present, CPF members aged 55 and above have two savings accounts meant for their retirement payouts, which are the SA and RA.

Before turning 55, members also already own an OA and a Medisave Account (MA).

Source: CPF Board on YouTube

With the removal of the SA, they can transfer their savings from the OA to the RA. They will be able to do so up to the ERS, which refers to the maximum amount that can be put into the RA to receive payouts.

In 2025, the revised ERS will be raised three to four times the Basic Retirement Sum (BRS).

With more funds in their RA, members can continue earning the long-term interest rate and obtain higher retirement payouts.

DPM Wong explains rationale for closure

In his interview with CNA, DPM Wong highlighted that the move was “very much in line with the purpose and intent of the CPF”.

Source: CNA on YouTube

He emphasised that the principle behind the SA having higher interest rates is due to its long-term nature.

However, those aged 55 and above also have the RA, which earns the same long-term interest rate as the SA.

Hence, by closing the SA, their savings will be streamlined to just their RA.

DPM Wong added that the “vast majority of Singaporeans” will be able to transfer their excess funds from the SA to the RA. CPF’s website reported this figure to be more than 99% of eligible members.

By doing so, members can still earn the same long-term interest rate, and ultimately higher retirement payouts.

Also read: Budget 2024: S$4,000 SkillsFuture top-up in May for S’poreans 40 years old & above

Budget 2024: S$4,000 SkillsFuture top-up in May for S’poreans 40 years old & above

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from CNA on YouTube and Google Maps.

Drop us your email so you won't miss the latest news.