Woman Loses S$72,500 Saved Over 40 Years After Downloading Third-Party App

In recent times, there’ve been several cases of people in Singapore losing large sums of money after installing dubious apps on their phones.

A 68-year-old lady unfortunately fell victim to such a scam recently. She lost S$72,500 in savings after installing a third-party app to sell her pre-loved kitchen appliances.

Source: Berita Harian

The elderly woman had reportedly spent the last 40 years saving up the money and was heartbroken to see it gone in just 15 minutes.

Woman reaches out to Facebook page to sell secondhand appliances

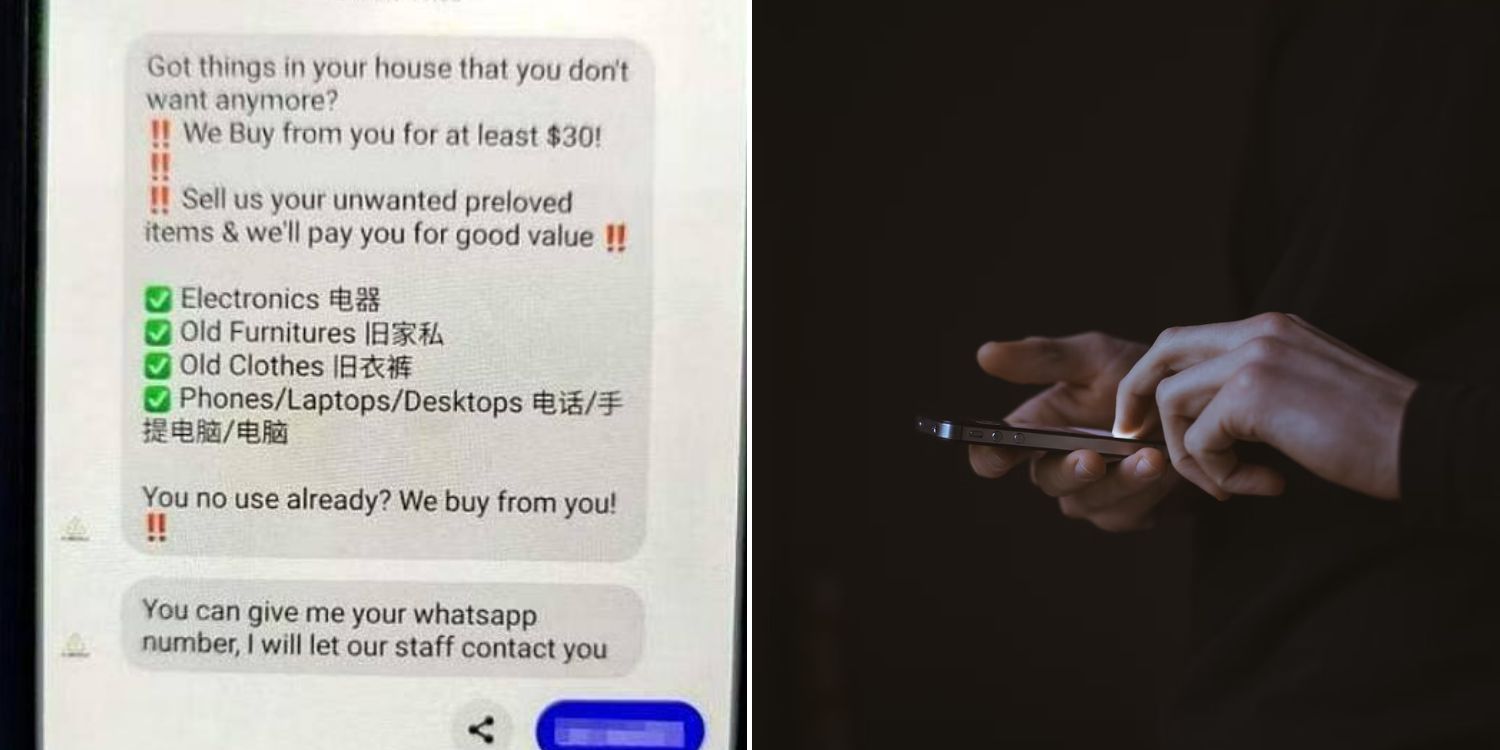

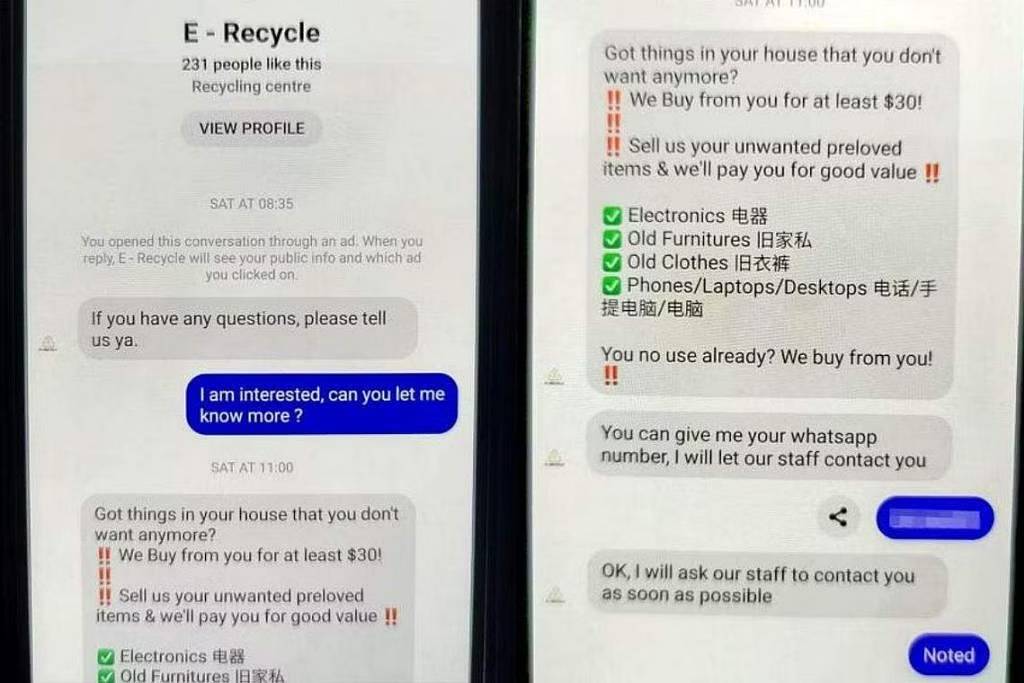

Speaking to The Straits Times (ST), 68-year-old Madam Abdul said she came across a Facebook advertisement on 23 Sep put up by a page named “E-Recycle”.

The page claimed to be a recycling company looking to buy pre-loved furniture and electronic products.

Madam Abdul told ST that she was drawn in by the deal that E-Recycle was offering — S$30 to S$100 for each item with free pick-up.

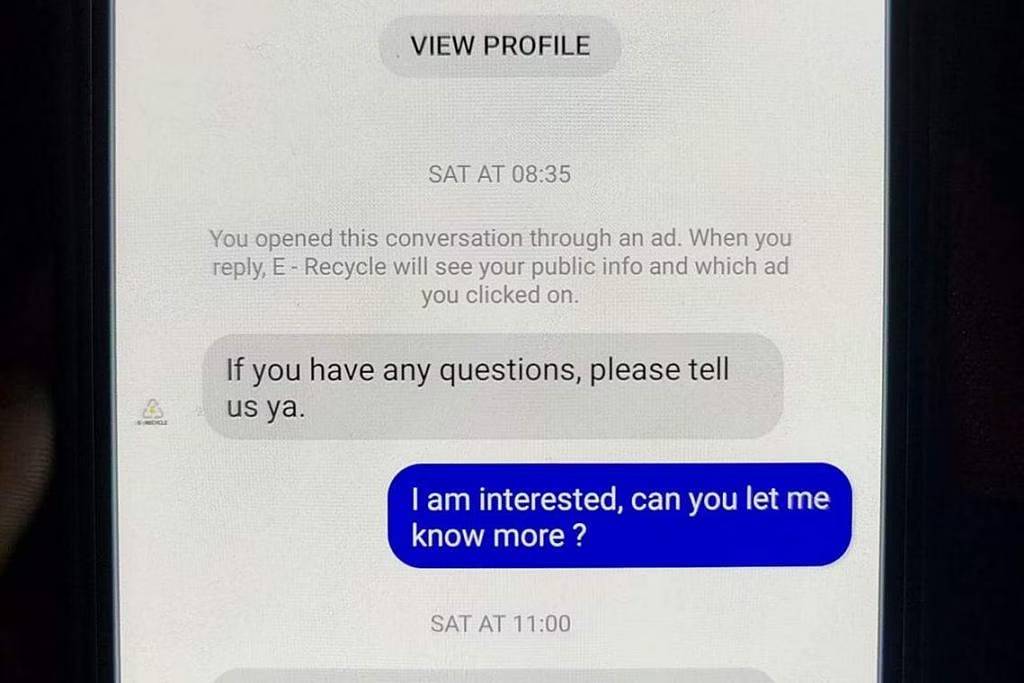

Keen to sell some of her used kitchen appliances, the customer service officer contacted the page via Facebook Messenger.

Source: Berita Harian

The buyer then got in touch with Madam Abdul via WhatsApp before calling her the next day.

During the call, the buyer told Madam Abdul that he had transferred her S$50 through PayNow as a downpayment for her items.

He then instructed the 68-year-old to open her POSB digibank app and check if she received the funds. Madam Abdul later found that she did not.

However, she did’t think much of it as she thought the transfer would take some time.

Loses S$72,500 after downloading 3rd-party app

With the banking app still running in the background, the buyer instructed Madam Abdul to download a third-party app and list her items on the platform.

Shortly after, she received another call and her mobile phone screen started glitching.

With the buttons on her touchscreen becoming unresponsive, Madam Abdul was unable to install the app.

When she highlighted the issue to the seller and asked if he was a scammer, he reportedly turned the tables by asking her not to compare him to other scammers.

Sensing that something was amiss, Madam Abdul approached her roommate, who advised her to switch her phone off and call POSB.

However, it was too late by then. Madam Abdul learned that the scammers had siphoned S$72,500 from her account.

Spent 40 years amassing the sum

Madam Abdul told ST that she spent four decades saving the sum, which she had set aside for retirement, insurance, and medical expenses.

Seeing such a large amount of money disappear within 15 minutes, the 68-year-old was understandably distraught:

When I heard that almost 90% of my savings was lost, I wanted to cry but no tears came out.

Madam Abdul has since reached out to POSB to assist with freezing her account. She has also lodged a police report.

Earlier this month, local banks DBS, OCBC, and UOB announced the ‘money lock’ security feature, which will allow customers to ‘ringfence’ sums in their accounts that cannot be withdrawn electronically.

DBS, OCBC & UOB To Launch Security Feature For Customers To Block Digital Fund Transfers

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Berita Harian and Gilles Lambert on Unsplash.