Lower downpayment of 2.5% for young couples applying for new HDB flats

From June this year, young couples in Singapore will enjoy a lower downpayment of 2.5% when applying for new Housing & Development Board (HDB) flats.

This change comes under HDB’s enhanced Staggered Downpayment Scheme, which aims to reduce the initial cost that couples need to pay upfront for their flats.

National Development Minister Desmond Lee highlighted the new measure during today’s (5 March) Parliament Sitting.

Initial downpayment still exerts financial burden on young couples

In a press release about greater support for young couples in owning homes, HDB detailed the enhanced measures in the pipeline.

Citing Mr Lee’s speech in MND’s Committee of Supply debate, the board noted that the measures apply to young couples, who include:

- Full-time national servicemen (NSFs)

- Full-time students

- Those who completed their studies or National Service within the last 12 months before applying for the HDB flat eligibility (HFE) letter

At present, these couples can wait until key collection to undergo their income assessment for loans or housing grants. This provides them with more time to be eligible for grants, and may also enable them to score a higher loan amount.

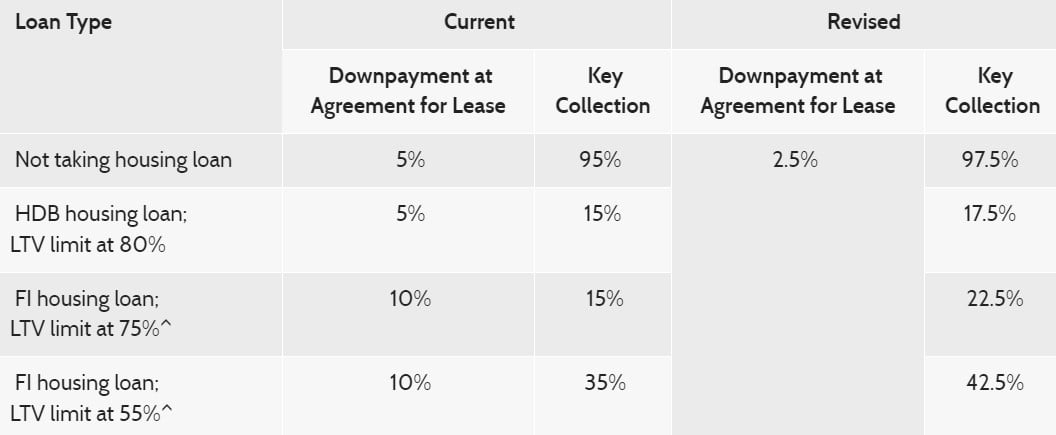

Additionally, they can pay the 20% initial downpayment for their flats in two instalments — the first is either 5% or 10% of the flat purchase price, while the second is paid when they collect their keys.

The aforementioned deposit was already reduced before.

However, HDB noted that the upfront deposit is still a substantial sum for some young couples. As they have already delayed their income assessment, they will only be eligible for grants like the Enhanced CPF Housing Grant (EHG) closer to key collection.

Enhanced scheme will reduce initial downpayment to 2.5%

Taking the couples’ financial burden into consideration, the enhanced scheme will further reduce the initial downpayment to 2.5%.

The amount that flat owners have to fork out at key collection will then vary depending on their loan type.

Source: Housing & Development Board

For those taking a housing loan, they have to pay 17.5% of the flat’s purchase price when they collect their keys. On the other hand, those taking a financial institution housing loan have to foot 22.5% of the purchase price.

This reduction will take effect in June this year, when the Build-To-Order (BTO) sales exercise commences.

Also read: 4,126 BTO flats launched in estates like Punggol & Bedok, most have less than 3.5 years’ wait

4,126 BTO flats launched in estates like Punggol & Bedok, most have less than 3.5 years’ wait

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from soonwh on Canva, for illustration purposes only.