HSBC Buys UK Arm Of Silicon Valley Bank For 1 Pound

The stock market is currently reeling from the closure of Silicon Valley Bank (SVB), exposing tech companies worldwide to financial risks.

SVB’s arm in the United Kingdom (UK), however, is now in safe hands after HSBC Bank bought it for the nominal price of £1 (S$1.64).

Better yet, the British government said no taxpayers’ money was used in the resolution.

HSBC says Silicon Valley Bank acquisition completes immediately

In a media release on Monday (13 Mar), HSBC announced that its subsidiary, HSBC UK Bank plc, would acquire Silicon Valley Bank UK.

Source: Frederic Rombaut on Facebook

The bank said the £1 (S$1.64) transaction, completed immediately, will be funded from existing resources.

HSBC Group CEO Noel Quinn said the move makes “excellent” strategic sense. SVB UK is ringfenced from its US parent company, and its assets and liabilities were excluded from the transaction.

SVB UK had loans of around £5.5 billion (S$9 billion) and deposits of around £6.7 billion (S$8.2 billion) as of 10 Mar.

Mr Quinn welcomed SVB UK’s customers, assuring them they can continue to bank as usual and that HSBC would back their deposits.

Silicon Valley Bank UK resumes operations after HSBC acquisition

Following the news, SVB UK said on Twitter that they’ll resume normal operations from Monday (13 Mar).

Source: Silicon Valley Bank UK on Twitter

Clients shouldn’t notice significant changes, they added.

However, they warned of “short delays” over the next few days.

No taxpayers’ money used

In a press release on 13 Mar, the British government said SVB UK customers can access their deposits and banking services as normal.

They added that HSBC is “the largest bank in Europe” and serves 39 million customers globally.

Thus, the statement said the sale has protected both the SVB UK customers and taxpayers.

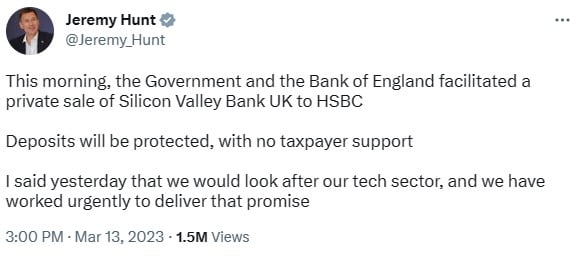

That’s because, according to British Chancellor Jeremy Hunt’s post on Twitter, no taxpayer support was needed.

Source: Jeremy Hunt on Twitter

He expressed in the government’s statement that he was “pleased” to reach a resolution after talks between the government, regulators, and prospective buyers over the weekend, adding,

HSBC is Europe’s largest bank, and SVB UK customers should feel reassured by the strength, safety and security that brings them.

Singapore’s banks have ‘insignificant exposures’ to SVB, says MAS

While the saga seems to have ended happily in the UK, Singaporeans might wonder what the situation is like here.

To that, the Monetary Authority of Singapore (MAS) has assured that our banks have “insignificant exposures” to the United States (US) bank closures, including SVB’s.

In a media release on Monday (13 Mar), MAS said Singapore banks are well-capitalised and conduct regular stress tests against risks.

Their liquidity positions are also healthy and underpinned by a stable, diversified funding base.

Thus, our banking system remains “sound and resilient”, able to weather potential stresses from global financial developments, MAS added, noting,

The Singapore Dollar money market and foreign exchange market continue to function well.

Impact is limited, according to start-ups

The central bank is assessing any potential impact on our start-ups and has gleaned initial feedback.

The response indicates that the impact is “limited”, MAS said.

Nevertheless, MAS is closely monitoring developments internationally and in Singapore’s financial system for signs of stress.

They’re ready to provide liquidity to ensure our financial system stays stable and financial markets function in an orderly manner.

US shut down two banks in one week

Last week, US regulators shut down two banks in one week, seizing assets amounting to US$319 billion (S$428 billion).

At the time of its shutdown, Signature Bank had US$110 billion (S$147 billion) in assets, while SVB had US$209 billion (S$281 billion).

Their shutdowns are now the second and third largest US bank failures in history.

Following news of SVB’s closure, there were concerns over whether the many tech start-ups that banked with them would be able to pay their staff.

Also read:

US Authorities Shut Down Two Banks In One Week, Combined Assets Amounted To S$428 Billion

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Joshua Lawrence on Unsplash and Frederic Rombaut on Facebook.

Drop us your email so you won't miss the latest news.