70% S’poreans & PRs Don’t Have Enough Savings To Tide Them Through Unemployment

With an economic recession – possibly one of Singapore’s most severe – looming on the horizon, many citizens could be facing unemployment woes in the near future.

Despite government grants, some are also worried about setting aside enough savings to tide them through job transitions.

According to a survey of 1,000 citizens, OCBC shared findings that were pretty troubling on Monday (1 Jun).

Image courtesy of OCBC

Image courtesy of OCBC

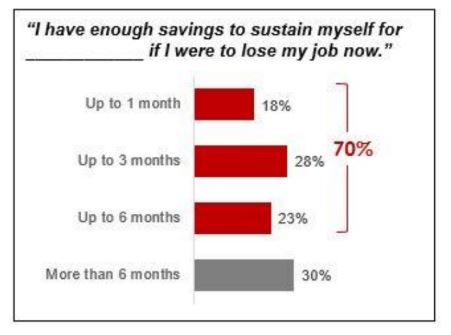

Specifically, 7 out of 10 working Singaporeans & PRs shared they had insufficient savings to cover more than half a year of unemployment.

Citizens aged 21 to 65 years old surveyed

To fairly represent different income levels & create an accurate sample size, 1,000 working Singaporeans & PRs aged 21-65 were surveyed.

Different income levels were also taken into account in a survey done 1.5 months into our Circuit Breaker.

Wage cuts & forced no-pay leave impact incomes

Nearly half – about 47% – described a “dip in income”, after experiencing the following measures at work:

- Wage cuts

- Forced no-pay leave

- Reduced commission

About 46% shared that they continued to worry about retrenchment despite governmental support.

70% don’t have sufficient emergency savings

As for retirement, about 1 in 4 Singaporeans shared they had ceased saving up or have chosen to reduce their funds.

Image courtesy of OCBC

Image courtesy of OCBC

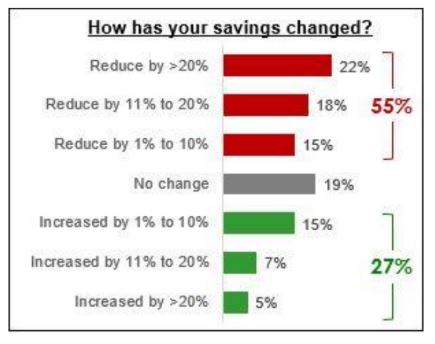

Many have turned to dipping into their savings to tide them through this period — with 55% of respondents’ savings reduced since the Circuit Breaker began.

For a fifth of these citizens, they’ve used more than 20% of their savings thus far.

Finally, about 70% shared they didn’t have enough “emergency savings” to support themselves & their families beyond 6 months, if retrenchment occurred.

Getting a second job & reskilling via online courses

On the bright side, 1 in 2 respondents have signed up for online courses to pick up new skills while on the hunt for new jobs.

And 61% described that they’ve been “working harder than before” since the onset of the Covid-19 pandemic.

Many of them shared that they’ve been “doing so to keep their jobs”.

As for looking for a second job, 1/3 of respondents have expressed that they’ll be open to the idea to make ends meet.

Exercise prudent spending & plan ahead

Although the economic outlook seems grim, we hope these respondents will be able to exercise financial prudence to allow them to stretch their savings in supporting their loved ones.

As we await more support measures to kick in, it’s also good to consider applying for other government schemes. This will help us be extra prepared to fend off retrenchment woes in the near future.

Do you have enough savings to tide you through half a year of unemployment? We’d love to hear your thoughts in the comments below.

Featured image adapted from TheSmartLocal.