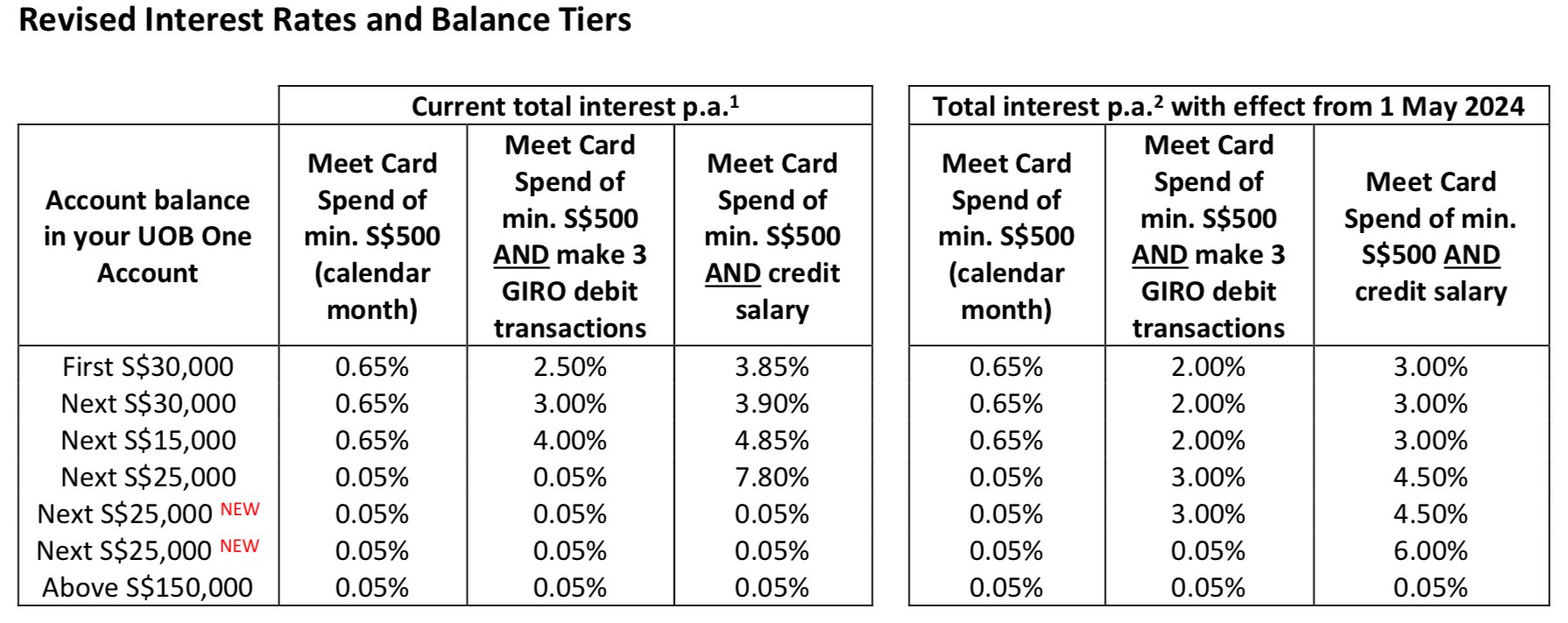

UOB cuts maximum interest rates from 7.8% to 4.5%

From 1 May, UOB will be reducing the interest rates for its flagship savings account, UOB One Account, to between 3% and 4.5% per annum.

This is a stark decrease from its current range of 3.85% to 7.8%.

With this move, UOB becomes the first bank in Singapore to cut its interest rates, according to Channel NewsAsia.

It cited the need to align with “long-term interest rate environment expectations” as its main reason for the rate cuts.

UOB slashes interest rates on flagship savings account, 2 years after becoming bank with highest interest rate

UOB broke the news about the interest rate cuts in a letter to its customers on Monday (1 April).

Source: UOB on Facebook

Like many other local banks, UOB One Account provides interest rates in different tiers for customers with varying account balances and spending habits.

In 2022, it raised its maximum interest rate to 7.8%, becoming the highest among local banks at the time.

UOB Raises Savings Account Interest Rate Up To 7.8%, Now The Highest Among Local Banks

However, starting 1 May, the interest rate will range between 3% to 4.5% per annum.

This range applies to UOB One Account holders with balances of up to S$100,000 who credit their salaries to the bank and meet a minimum spend of S$500 a month on an eligible bank card.

Bank introduces 2 new tiers for those with more than S$100,000 in their balances

Additionally, it shared that it will introduce two new balance tiers to the UOB One Account, also from 1 May onwards.

Source: UOB

The new tiers will thus raise the maximum bonus interest-earning balance from S$100,000 to S$150,000.

To qualify for the new tiers, account holders would need to have account balances above S$100,000 and meet the same salary and spending criteria as the other tiers.

“With these changes, you can now earn up to S$6,000 total interest in a year for deposits of S$150,000 when you spend a minimum of S$500 on eligible UOB Cards and credit your salary via GIRO/PayNow each calendar month,” the bank added.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from UOB on Facebook.

Drop us your email so you won't miss the latest news.