SingPost Customers To Pay GST For Imports Via Cashless Methods Before Receiving Delivery

UPDATE (6 Oct, 6.25pm): An earlier version of this article stated that SingPost will be charging GST on imports. We have since updated it to clarify that from 1 Nov, payment for GST/duties on imported goods exceeding $400 in value or dutiable and controlled goods can be done via the SingPost Mobile app, SAM kiosks, or at any SingPost office before the delivery.

–

Most Singaporeans are fans of online shopping, especially with the cheap prices commercial platforms have to offer.

Buying products in bulk often means racking up a hefty bill in hundreds of dollars, which some of us may be familiar with. To bring the haul in, SingPost charges customers duties or Goods and Services Tax (GST) on goods valued above $400.

Currently, customers would have to pay that amount in cash upon receiving their orders.

But from 1 Nov 2021, they will have to pay those charges through the SingPost mobile app, SAM kiosks, or at any post office before SingPost makes the delivery.

SingPost GST/duty payments to be cashless from 1 Nov

In a Facebook post on Tuesday (5 Oct), Singapore Customs informed members of the public about a new update. The update appears to be in line with measures SingPost had introduced earlier on 1 Oct.

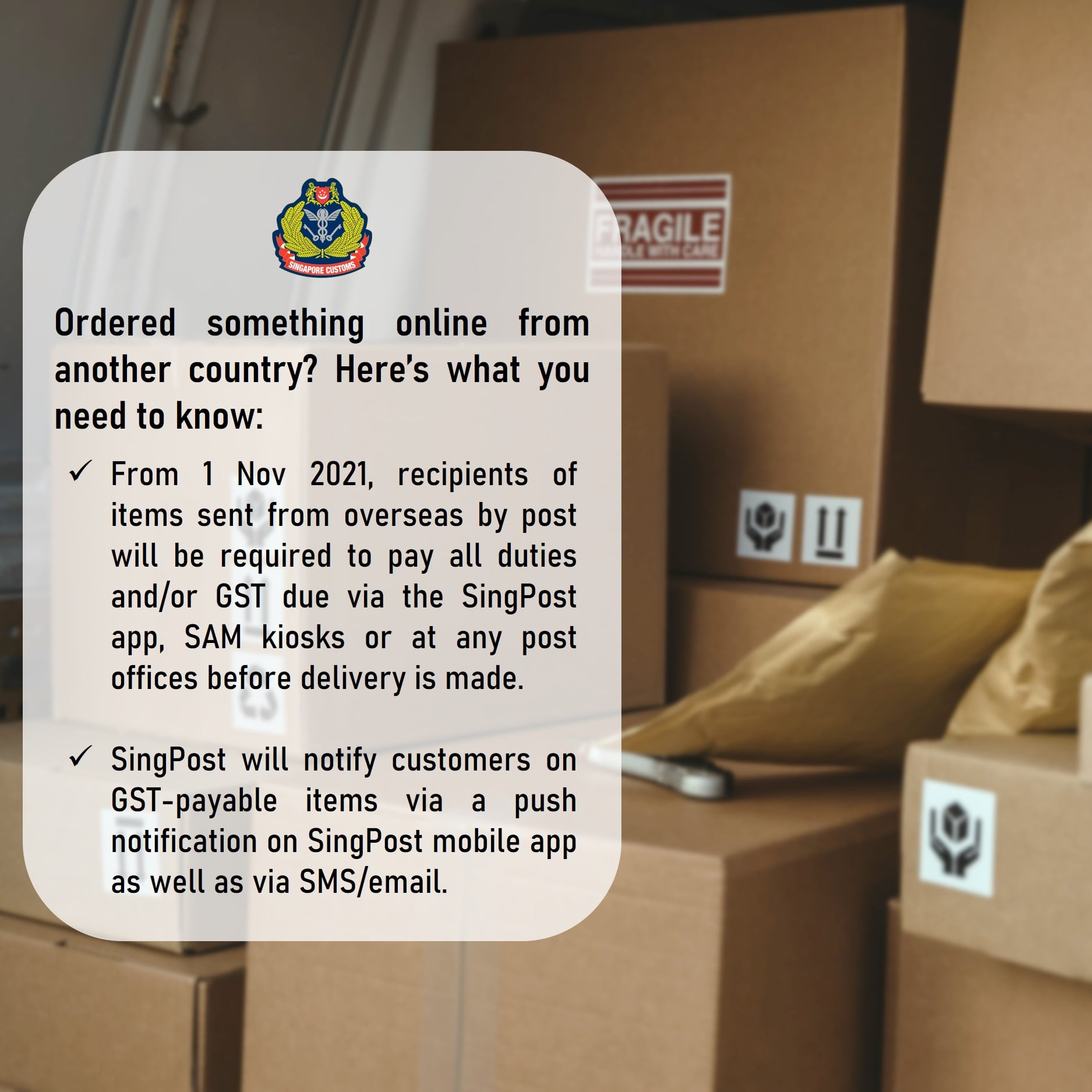

From November onwards, those who have ordered parcels from overseas will have to pay a GST fee in advance before SingPost delivers the item.

The fee can be paid via the SingPost mobile app, SAM kiosks, or any post offices before delivery is made.

However, there will be no GST applied to non-dutiable and non-controlled items that are less than, or equal to $400. This does not apply to liquor and tobacco products.

The GST for low-value imports will only be imposed from 2023 onwards, as mentioned in Deputy Prime Minister Heng Swee Keat’s Budget speech in February.

But for imports that are currently duty or GST payable, recipients will be notified regarding their charges through SingPost’s mobile app, SMS, email, or letter.

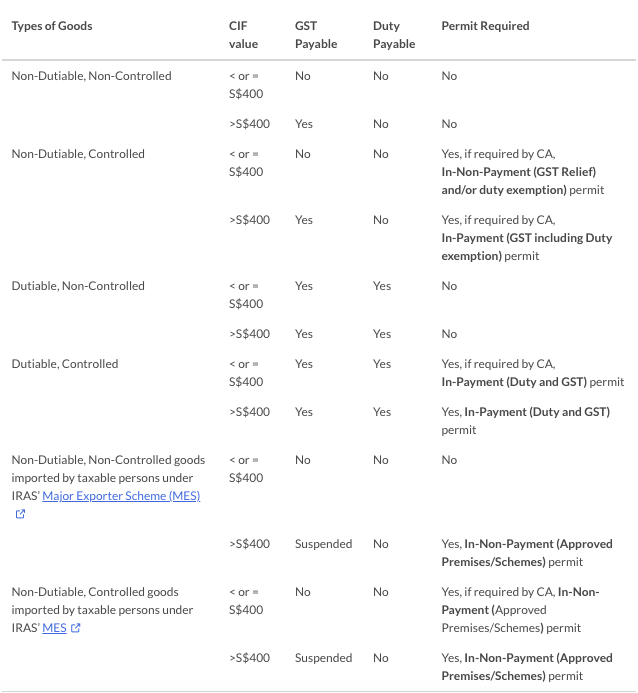

Here is a breakdown of what sort of goods will be implicated:

Parcels must have their commercial invoice attached

SingPost will notify individuals once they have computed the GST or duties on any of the relevant goods which they have listed above.

Once customers have made the payment, they’ll likely receive their parcels within 2-3 working days. SingPost may impose other charges as well, so do take note.

SingPost will also withhold any parcels that are missing their commercial invoice.

They will then notify the addressee to submit an invoice and other supporting documents to the Immigration & Checkpoints Authority (ICA) for validation.

Recipients will have 14 days from the date of notification to pay. Otherwise, SingPost will return the item to the sender.

Those eligible for GST waivers can send a copy of the following to SingPost’s email before the delivery:

- a copy of the import permit of the items

- tracking number of the shipment

Take note if you’re receiving certain packages

While the changes will only affect those who order high-value imports or dutiable, non-controlled goods, it helps to know the procedures in case we need to deal with them in the future.

Let’s hope the transition will be a smooth one especially for people handling such orders regularly.

Have news you must share? Get in touch with us via email at news@mustsharenews.com.

Featured image adapted from Google Maps and SingPost on Facebook.