Fake Bank Calls Ask For One-Time Pin

A call from the bank would make anyone nervous. After all, they’re holding most of your money, so anything going wrong would be a major emergency.

Unless you happen to answer a sales call, in which case, good luck sitting through that.

But if the call happens to be quick and requires you to disclose sensitive information, you might want to hang up immediately.

The Singapore Police Force (SPF) released an alert on Thursday (21 Feb) advising Singaporeans to be wary of a new scam targeting bank customers.

Fake number resembles bank hotline

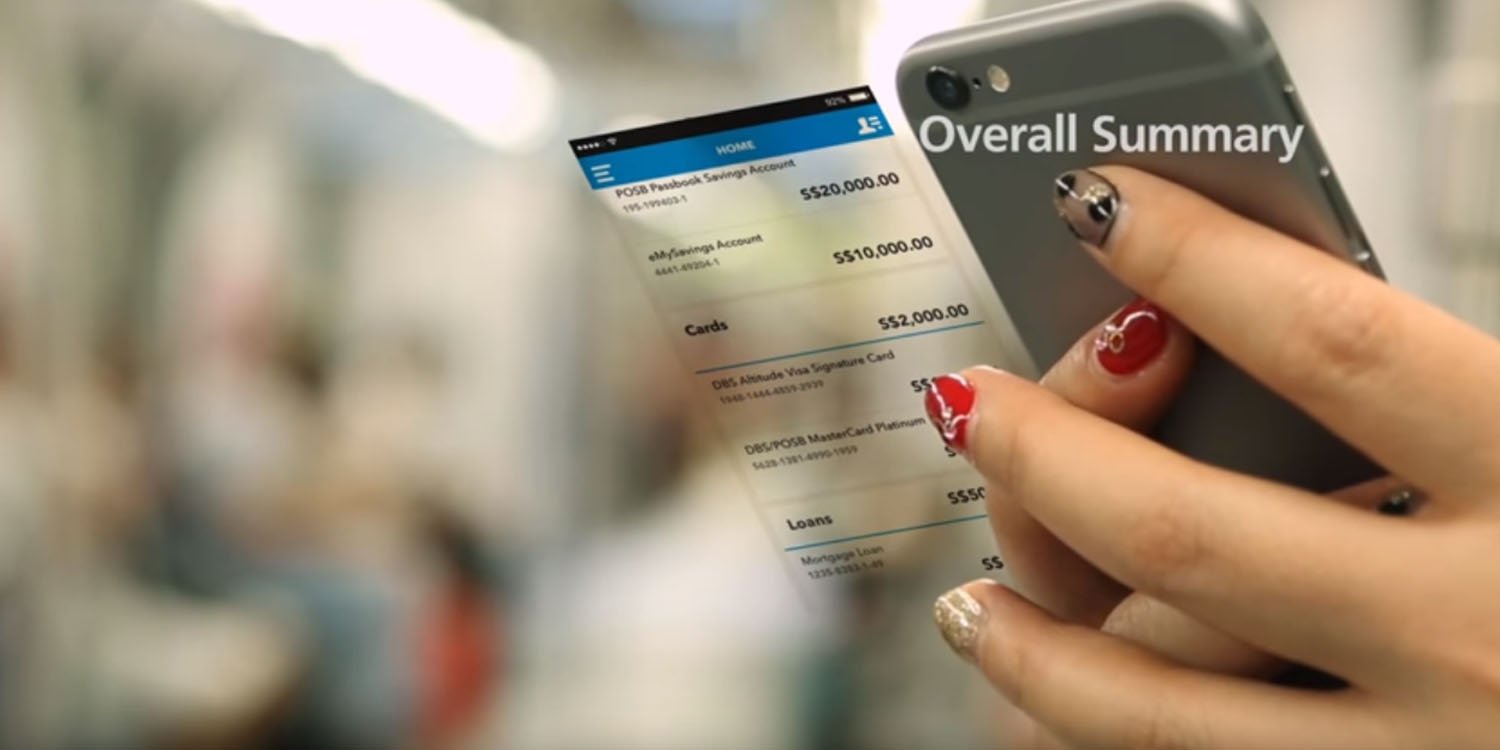

This is how the scam works — someone claiming to be a bank employee calls a customer via a fake number resembling the bank’s personal banking hotline.

The unsuspecting customer would think the call is harmless because the number looks legit.

So they willingly give their One-Time Pin (OTP) to “authenticate” their bank account when asked.

Some time later, the victim finds that unauthorised transactions have been made from his or her account.

Banks will never ask for PIN numbers

You might think that the likelihood of falling for such a scam is low, but you should consider how anxious people get when receiving official calls.

You’d get nervous about what the call could be about and might forget to think clearly.

But the most important thing to remember is that banks will never ask for sensitive information like your PIN numbers. DBS states that clearly on their website.

In general, all banks expect customers to follow safety measures which include not giving security details like your user ID, PIN and OTP to anyone.

So remember this if you ever receive any suspicious calls from a bank in the future.

Follow crime prevention measures

SPF has advised members of the public to follow these crime prevention measures:

- Beware of random calls from “banks” — scammers may mask their actual phone number with the bank’s number.

- Don’t give your iBanking details like user ID, PIN or OTP to anyone through phone, email or SMS.

- Don’t respond to any suspicious authentication requests if you didn’t make a transaction.

- If the call sounds suspicious, hang up and call the hotline available on the bank’s website to verify the authenticity.

Here are the personal banking hotlines for the major local banks:

- DBS — 1800 111 1111

- POSB — 1800 339 6666

- OCBC — 1800 363 3333

- UOB — 1800 222 2121

- HSBC — 6472 2669

Any information on scams should be directed to the SPF hotline at 1800 255 0000 or their website at https://www.police.gov.sg/iwitness.

If you need scam-related advice, call the anti-scam helpline at 1800 722 6688 or visit www.scamalert.sg.

Remember to be alert when answering suspicious phone calls and inform the police if you ever receive one.

Featured image from YouTube.

Drop us your email so you won't miss the latest news.