Chicken Rice Prices Rose From S$3.13 To S$4.03 Between 2014 & 2022

If “Covid-19” best defined 2020 and 2021, then “inflation” is probably the most accurate word to describe 2022.

From the ongoing crisis in Ukraine to increased consumer demand and supply chain chokepoints, there have been numerous factors driving up the prices of our everyday goods and services.

While there are many ways to study the effects of inflation, the MS News team thought it might be interesting to do so by examining the prices of our unofficial national dish – the humble chicken rice – and how they have risen over the years.

Unlike economy rice, the price of which varies depending on the dishes chosen, the ingredients in chicken rice are generally fixed, making for a fairer comparison.

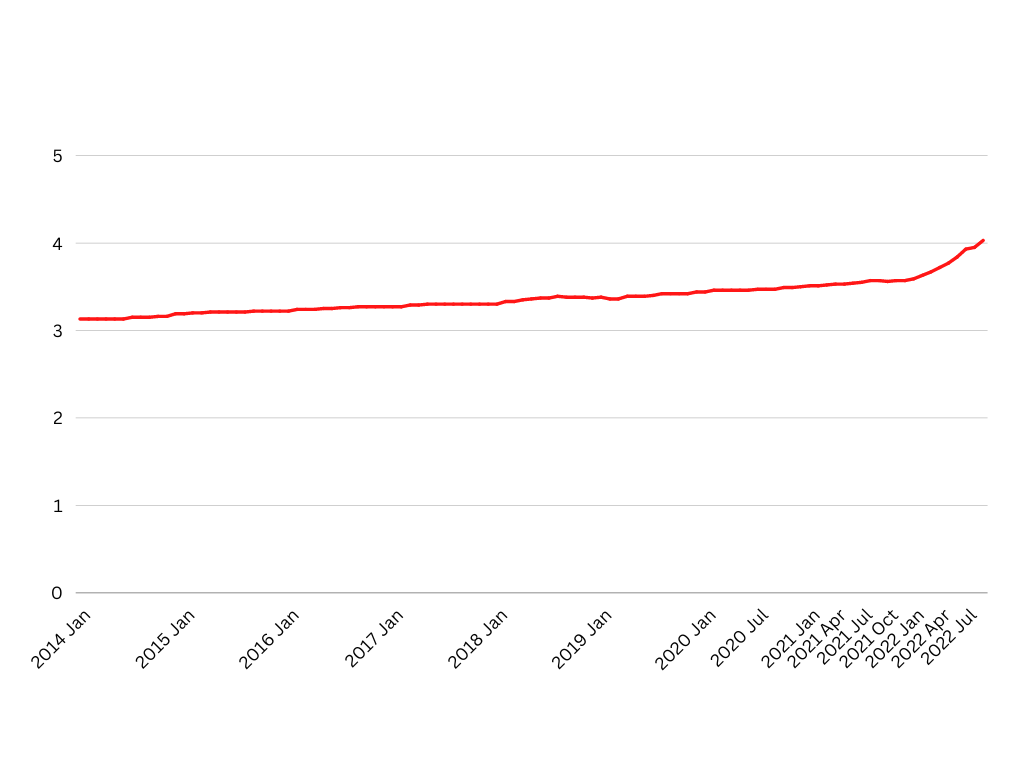

Sure enough, data shows that between 2014 and 2022, the price of a plate of chicken rice rose to S$4.03 from S$3.13.

Rise in chicken rice prices coincided with Malaysia’s chicken export ban

To derive how much a plate of chicken rice cost between Jan 2014 and Sep 2022, we sourced data collected from the Department of Statistics Singapore.

Graph by MS News

According to the data, a plate of chicken rice – defined by the department as chicken rice with breast meat – cost about S$3.13 back in the early months of 2014.

Chicken rice prices remained largely unchanged between 2014 and 2021, seeing a slight increase of S$0.38 that brought it up to S$3.51. This translates to an average increment of about S$0.05 per year.

However, from 2021, price increases became more frequent – during seven out of 12 months in 2021, chicken rice prices went up.

The trend only worsened in 2022, which saw chicken rice prices rising between S$0.02 to S$0.08 each month.

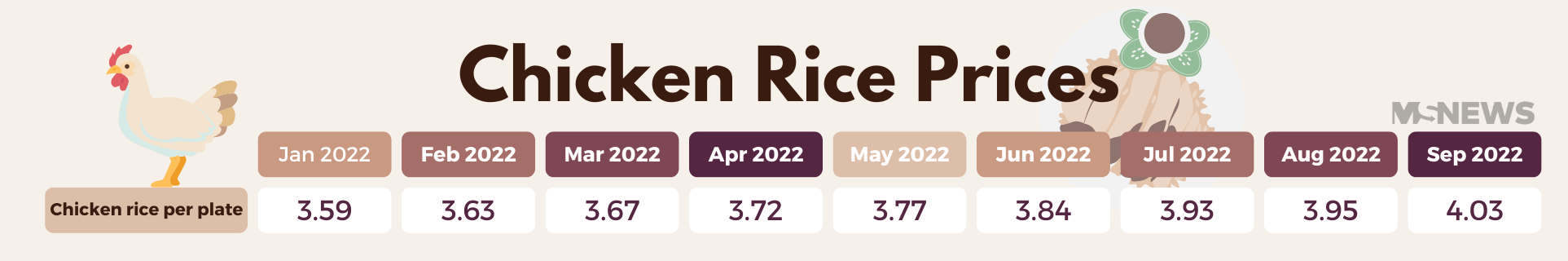

Table by MS News

Interestingly, the monthly price increases became more pronounced in Apr 2022, around the same period when Malaysia announced its chicken export ban.

As of Sep 2022, a plate of chicken rice costs about S$4.03 on average.

The role of inflation in chicken rice price increase

So what happened?

Well, from the sliced cucumber to the spices in the chilli sauce, everything that goes into a plate of chicken rice is subjected to the effects of inflation.

That’s especially the case for Singapore, which reportedly imports over 90% of the food we consume from other countries, leaving us especially vulnerable to external factors.

As far as external factors are concerned, it seems that the key event that caused the recent surge in chicken rice prices was the Malaysian chicken export ban that kicked in on 1 Jun 2022.

The hows & whys of inflation

So why exactly does inflation happen, and is it necessarily the nemesis of our hard-earned money?

Inflation occurs for many reasons but generally happens due to shifts in demand and supply patterns.

When supply for goods and services fails to keep up with increasing consumer demand, prices start to soar – a concept taught in many of our ECO101 lessons.

On the flip side, prices for goods and services may also surge due to higher production cost – expenses such as the cost of raw materials and wages.

There is also a ‘self-fulfilling’ type of inflation called ‘built-in inflation’.

In essence, people living in an inflationary climate may expect prices to continue rising. To maintain their standard of living, workers will naturally demand higher wages.

On the flipside, firms will also increase prices to keep up with the increased costs. Both of these forces will exacerbate the prevailing level of inflation.

As for the high inflation rates we’re seeing right now, these are some, but not an exhaustive list of factors behind them:

- Government fiscal and monetary stimulus during the pandemic

- Supply shortages amid rising consumer demand

- Raw material supply crunch caused by the Ukraine war

Basic strategies to deal with inflation

Now that you’ve understood the rough concept behind this hotly debated keyword, it’s imperative to start planning so that inflation hurts you a little less.

Here are some basic strategies everyone should know to survive inflation.

- Understand the ins and outs of your finances

- How much are you getting monthly, and where does the money go? It’s useful to get a complete picture of your budget, so you know where to cut and how much to save.

- Set a new goal on how much money you wish to save every month and do your best to hit it.

- Be strategic and play safe with investments

- If you’ve got an appetite for high-risk investments, now isn’t the time. Play safe and invest in the most mundane ways possible, e.g. diversified index funds or short-term bonds.

- It is also probably not the best time to think about cryptocurrencies and meme stocks.

- Be on the hunt for bargains and cashback

- Now’s the opportune time to get serious about 12.12, 1.1, 2.2, 3.3 (you get the idea) sales because that’s when you can get generous discounts on goods.

- Of course, this doesn’t mean you should spend unnecessarily — you can cart out items that you’re meant to buy anyway, like everyday necessities and household products.

- Reward programmes like PayLah!’s hawker stamp cards can also help you save while you spend by giving you cashback, so you can buy as many plates of chicken rice as you want.

- Postpone big-ticket purchases like buying properties

- HDB’s cooling measures and S$1 million resale flats are no joke. If you’ve been feeling discouraged about committing to a big-ticket purchase now due to the high costs, that’s probably the wise thing to do for now.

- But don’t stop looking if you’re in the market for your own house. Plan now and buy later when the markets are more stable again.

- Pay attention to interest rates and act on it

- It’s no secret that interest rates for saving accounts across Singapore banks are at a record high. If you’re unwilling to take a risk now with stock markets, you can play it safe by opening a fixed deposit account.

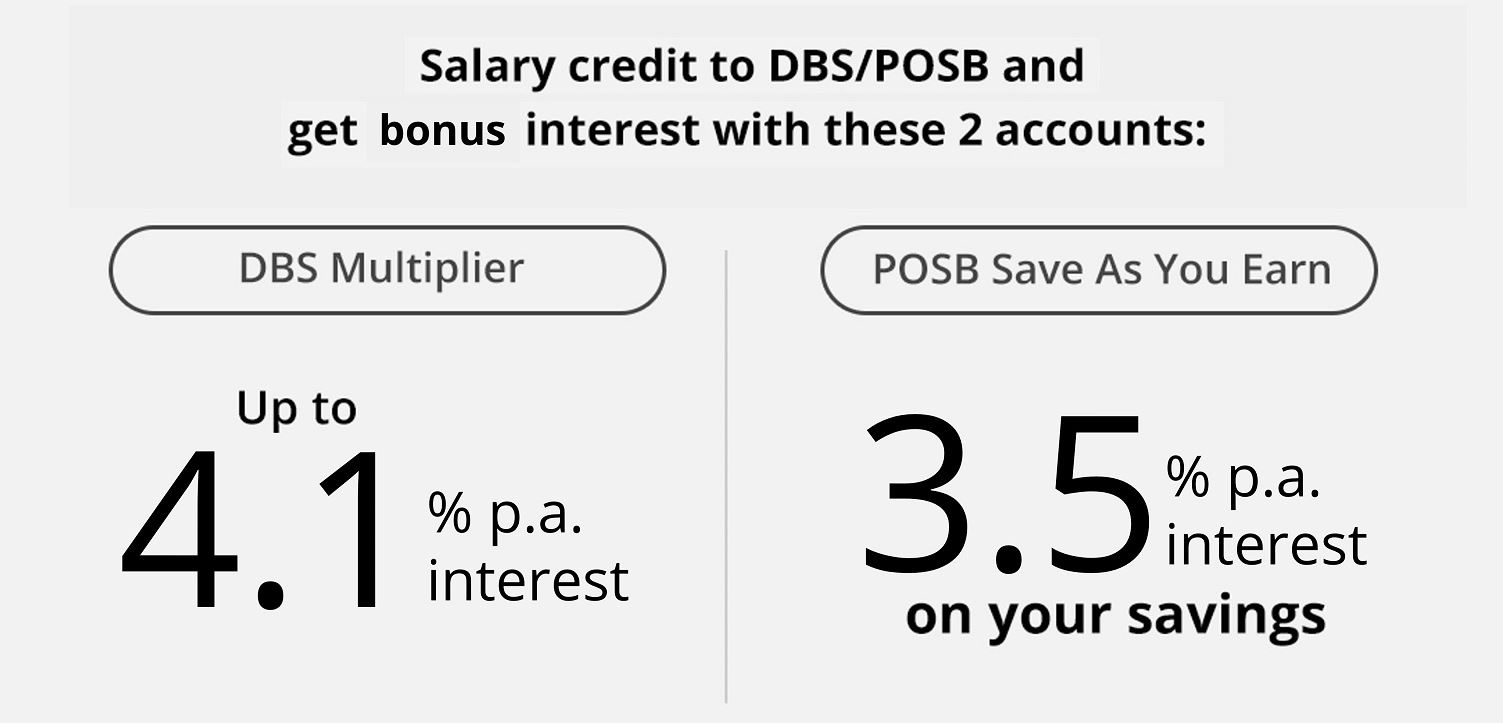

- Last we heard, DBS raised the interest rates of its Multiplier savings account by up to 4.1% on the first S$100,000 in the user’s account.

POSB has ways to inflation-proof your savings

What’s next? We’ve put together actionable steps you can consider when planning your financial goals.

Apart from opting for high-interest savings accounts like the DBS Multiplier, you can consider opening a POSB Save As You Earn (SAYE) Account store your precious funds for a rainy day.

A simple breakdown of how your salary works for you with Multiplier & SAYE

Source: POSB

If you set aside S$1,000 every month to be kept in a SAYE account, you earn 3.5% per annum on your savings.

Cash may be king right now due to harsh economic conditions, but sitting on too much excess cash can be counterproductive. Hit up POSB’s experts at digiPortfolio to discover stable ways to grow your money.

Besides saving and investing wisely, getting cashback on daily essentials is a popular way to amass more funds without feeling the pinch of being super thrifty.

With cards like DBS yuu Card, POSB Everyday Card, and PAssion POSB Debit Card, you can make the most out of buying groceries and paying for transport and utilities.

The new DBS yuu Card

Various promos are available now till 31 Dec, so be sure to check them out in time.

And finally, with the slew of cooling measures to slow down the property market, like higher interest rates on home loans, there’s a need to re-strategise your savings to make do.

POSB has put together two home loan packages to help prospective home buyers take one step closer to achieving their dreams:

- POSB HomeSaver – boost savings with up to S$700 cash bonus

- POSB HDB Home Loan – those earning less than S$2,500 per month can ease monthly repayments with an exclusive 2.6% p.a.

Visit the POSB website here for the complete walkthrough on how you can fight inflation.

The choices we make are now more important than ever

Topics related to personal finances may be evergreen, but in light of recent global and national developments, they’ve been thrust into the spotlight more than ever.

It’s easy to see why when everything is going up but your salary. While global affairs are out of our control, certain choices we make in life can make a difference.

Time to save more and spend wisely — your future depends on it.

This post was brought to you in collaboration with DBS/POSB.

Featured image adapted from Eatbook.

Drop us your email so you won't miss the latest news.