HDB Flat Eligibility Letter Will Be Issued For New & Resale Flats, Replaces HDB Loan Eligibility Letter

Buying an HDB flat is a milestone in one’s life, but may also be a somewhat onerous undertaking.

Documents are needed at various stages of the process to determine one’s eligibility, and buyers may not even know how much they would have to pay for their new home till right at the end.

That’s why HDB has introduced an HDB Flat Eligibility (HFE) letter.

It will make the process easier by streamlining the different eligibility assessments into one letter.

HDB Flat Eligibility letter needed from 9 May

In a press release on Friday (28 Apr), HDB said the HFE letter will be needed from 9 May.

For new buyers, it’ll be necessary when they apply for a flat from HDB during a sales launch or open booking of flats.

For resale flat purchases, the letter must be furnished to get an Option to Purchase (OTP) from the seller, as well as when a resale application is submitted to HDB.

Before 9 May, the HFE letter isn’t needed when doing the above.

3 levels of assessments for buyers

Currently, flat buyers have to get through three levels of assessments to determine whether they’re eligible to:

- buy a new or resale flat

- get a Central Provident Fund (CPF) housing grant (and the amount)

- get an HDB housing loan (and the amount)

Source: Housing & Development Board on Facebook

For an HDB housing loan, they must apply for an HDB Loan Eligibility (HLE) letter.

Relevant supporting documents, for example pay slips and CPF statements, must be provided at each stage.

A problem would be that buyers’ eligibility for these three aspects are still up in the air when they apply for a new flat or purchase a resale flat. Thus, HDB admitted that,

This may lead to some uncertainty among flat buyers on their housing budget.

HDB Flat Eligibility letter combines 3 assessments into 1 application

The HFE letter combines these three assessments into one application via the HDB Flat Portal.

It also replaces the HLE letter.

The move will “bring about more certainty and convenience to flat buyers”, HDB said.

They will also have a “holistic understanding and assessment” of their housing budget and financing options, and therefore,

… flat buyers will also be able to make more informed and prudent decisions in their home purchase.

Source: Ivan Yeo on Unsplash

Apply for an HFE letter in 2 steps

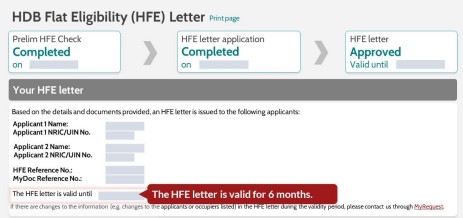

The new process works in two steps.

Firstly, prospective buyers must log in to the HDB Flat Portal using their SingPass to do a preliminary HFE check.

After submitting one’s personal particulars and declaring information like household income, the portal will give them a quick assessment of their eligibility for the three aspects.

If they have a firm intent to buy, users must proceed to the next step of applying for an HFE letter within 30 days.

This involves submitting the information and supporting documents of all applicants and occupiers.

The HFE letter will be sent to applicants within 21 days. It will contain the results of the three assessments and the amount of grants and loans they can get.

The letter is valid for six months from the date of issue.

Enhancements to HDB Flat Portal

Besides the new HFE letter, HDB announced that they’ll be merging the HDB Resale Portal and the HDB Flat Portal, also from 9 May.

The portal will be enhanced with an integrated loan application service. It will allow buyers to ask for an In-Principle Approval (IPA) and a Letter of Offer (LO) from participating financial institutions if they choose not to take a loan from HDB.

In fact, buyers may request an IPA from financial institutions to find out their eligibility for a housing loan while concurrently applying for an HFE letter. They may also request an LO via the HDB Flat Portal after securing a flat.

New buyers will continue to be guided by the HDB Flat Portal, including getting personalised info on their flat application to help them plan ahead.

Even appointments for key collection can be booked via the portal after the flat is ready.

Have news you must share? Get in touch with us via email at hello@mustsharenews.com.

Featured image from MS News.