Singaporean Shares Tips On How To Budget, Now Has Extra To Spend With Savings

For many young people, goals such as buying a BTO flat or going on faraway holidays mean saving up on hard-earned cash. Arguably, much of our savings can be attributed to our spending habits.

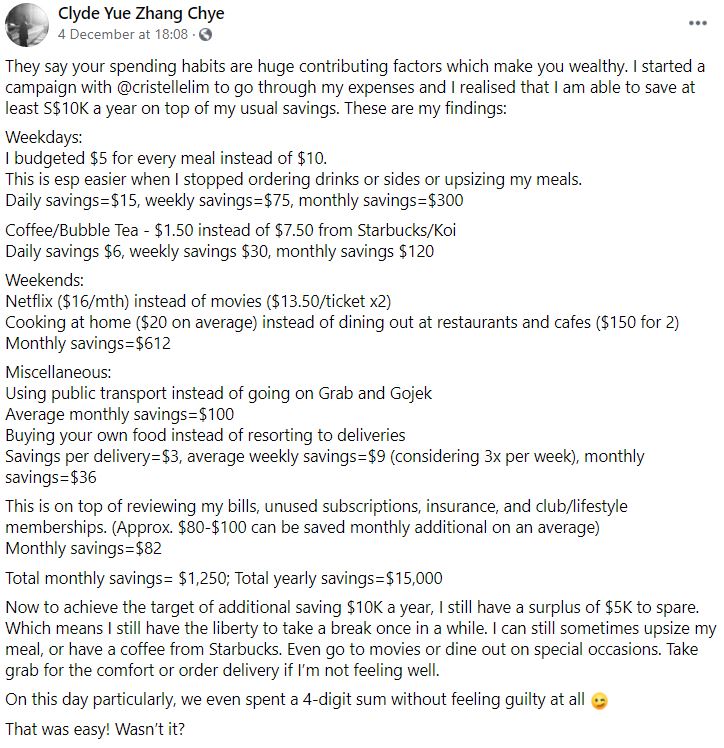

Facebook user Clyde Chye shared tips on how to save $15,000 a year.

Beware though, there are some luxuries that are hard to sacrifice — for example, if you’re a frequent bubble tea drinker, you might find this post difficult to read.

Bye bye Starbucks and Koi

In a Facebook post, Clyde shared that his weekday meals used to cost about $10, but was able to halve his meal costs by keeping them to $5.

He did this especially by not ordering drinks or sides, and skipped upsize meals.

This is reasonable enough. After all, a plate of cai fan rarely exceeds $3.50 if you order more veggies and keep the meat dishes to a minimum.

If you feel like treating yourself, a McDonald’s burger – ala carte, without drinks or sides – still fits the bill.

However, the real killers are high-end beverages like Koi or Starbucks, which can cost north of $7.50 for a venti-sized beverage.

Instead, Clyde says kopi or teh peng should be your new best friend to beat the heat as they cost around $1.50.

Making such tweaks to his weekday spending allowed this Singaporean to save about $120 per month.

It also helps that you’ll cut down on that sugar if you choose to do the same.

Savings per year:

$120 X 12 = $1,440

Skip dining out and the theatre for budget tips

In the age of Netflix, watching movies has become more affordable than ever.

Clyde said 2 weekend movie tickets for both him and his girlfriend costs $27 in total.

Instead, the duo chose to subscribe to Netflix at $16 per month.

Another money hack — cooking at home instead of dining out, he shares.

By doing so, you can watch movies and dine from the comfort of your home. Sounds like a cosy weekend to us.

In total, Clyde was able to save about $612 per month just by skipping the cinemas and restaurants.

Savings per year:

$612 X 12 = $7,344

Miscellaneous savings included in budget tips

With the convenience of private hire car services, one may be tempted to take a Grab car instead of taking the bus.

Clyde said he was able to save about $100 per month by opting for public transport.

Similarly, food deliveries cost more than tabao-ing your own meals, with each delivery costing about $3.

By going back to pre-GrabCar/Food times, and cutting away unused subscriptions, Clyde was able to save $82 per month.

Savings per year:

$82 X 12 = $984

Splurging occasionally is fine

If one tries a similar budgeting plan, about $9,768 can be saved.

Clyde said his yearly savings amounted to about $15,000 when budgeting is kept in mind.

With these savings, he says he didn’t have to feel guilty about splurging on the occasional Grab ride, Starbucks drink or dine out for special occasions.

Budgeting for a better future or rainy day

While these budgeting tips may not apply for everyone as we all lead different lifestyles, they do serve as inspiration for making subtle – or not so subtle – tweaks to our spending habits.

Some of these expenses also add up over time, and we can definitely pay more attention to what we use our money on if there are savings to be made.

We don’t have to completely push out life’s little luxuries, but sometimes, it wouldn’t kill to skip out on that venti Frappuccino.

Have news you must share? Get in touch with us via email at hello@mustsharenews.com.

Featured image adapted from Facebook and MS News.